UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ý

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| |

¨ | Preliminary Proxy Statement |

| |

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

ý | Definitive Proxy Statement |

| |

¨ | Definitive Additional Materials |

| |

¨ | Soliciting Material Pursuant to § 240.14a-12 |

Chuy’s Holdings, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| |

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) | Title of each class of securities to which transaction applies: |

| |

(2) | Aggregate number of securities to which transaction applies: |

| |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

(4) | Proposed maximum aggregate value of transaction: |

| |

¨ | Fee paid previously with preliminary materials. |

| |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) | Amount Previously Paid: |

| |

(2) | Form, Schedule or Registration Statement No.: |

June 11, 2013

Dear Chuy’s Stockholder:

You are cordially invited to attend the annual meeting of stockholders of Chuy’s Holdings Inc. The meeting will be held on Thursday, July 25, 2013, beginning at 9:00 a.m. at the Courtyard Marriott Downtown/Convention Center located at 300 East 4th Street, Austin, Texas 78701.

Information about the meeting, nominees for the election of directors and the proposal to ratify the appointment of our independent registered public accounting firm for 2013 is presented in the following notice of annual meeting and proxy statement. We hope that you will plan to attend the annual meeting.

It is important that your shares be represented. Whether or not you plan to attend the meeting, please vote using the procedures described on the notice of internet availability of proxy materials or on the proxy card or sign, date and promptly mail a proxy card in the provided pre-addressed, postage‑paid envelope.

We look forward to seeing you at the meeting on July 25th.

Sincerely,

Jose Ferreira, Jr.

Chairman

CHUY’S HOLDINGS, INC.

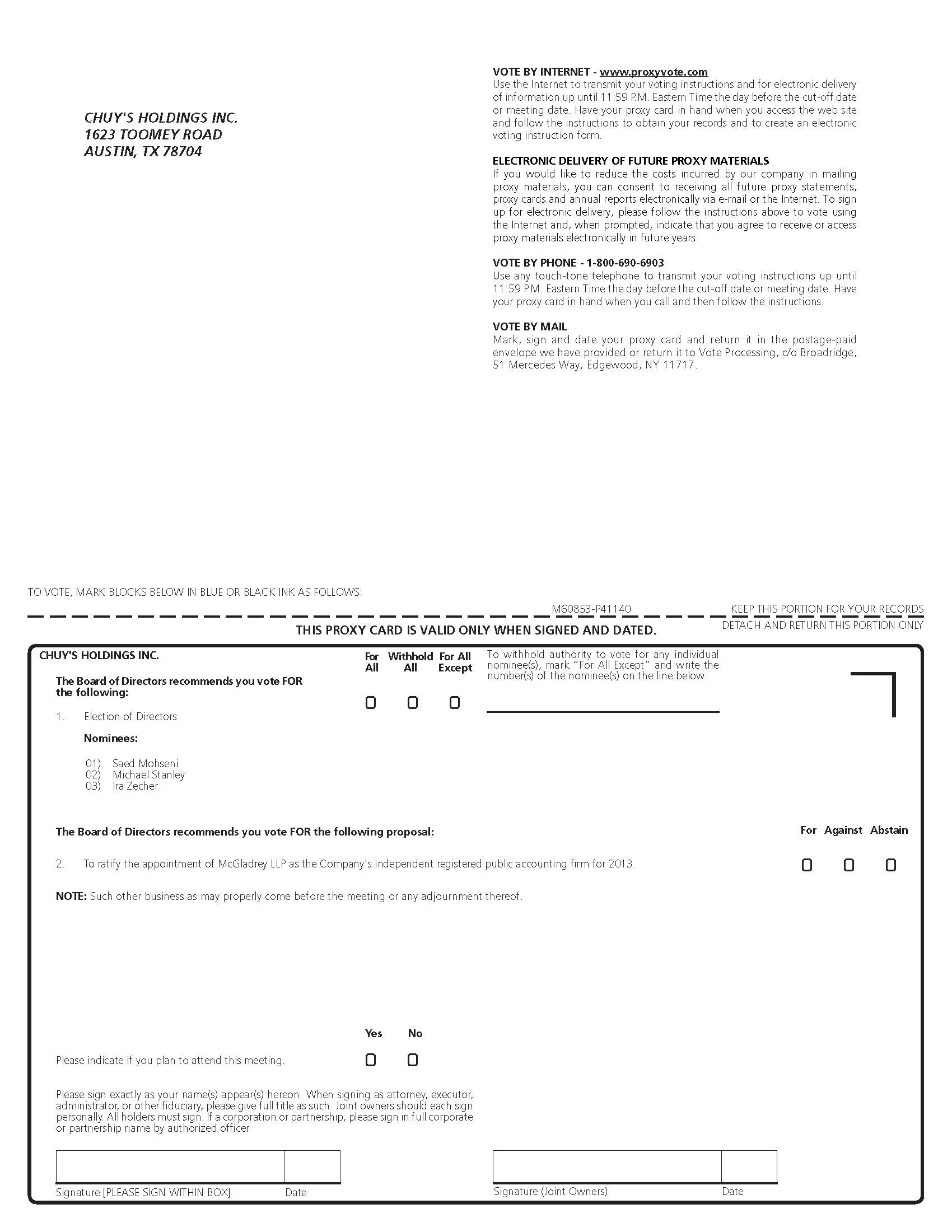

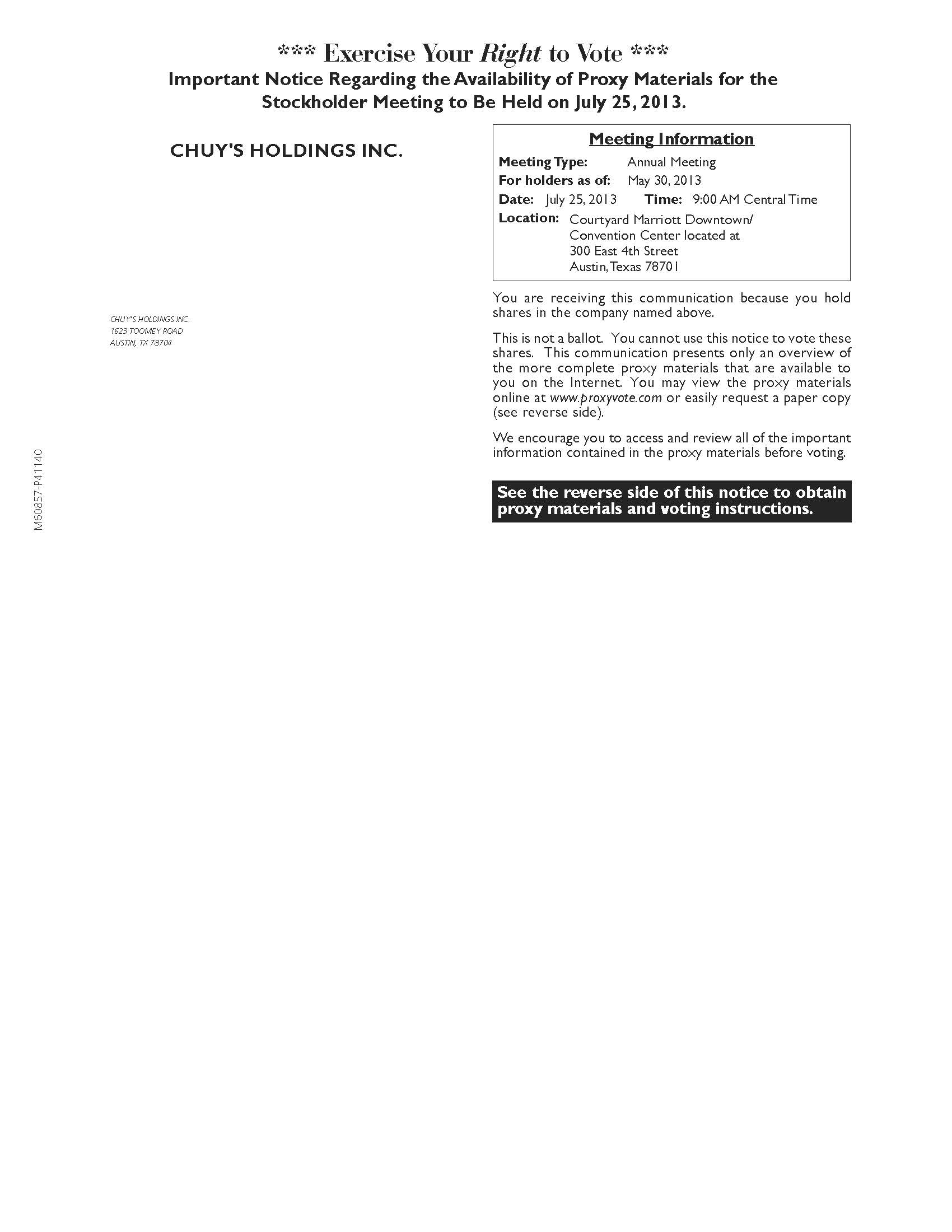

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on July 25, 2013

The 2013 annual meeting of stockholders of Chuy’s Holdings, Inc. (the “Company”) will be held on July 25, 2013, beginning at 9:00 a.m. at the Courtyard Marriott Downtown/Convention Center located at 300 East 4th Street, Austin, TX 78701. The meeting will be held for the following purposes:

| |

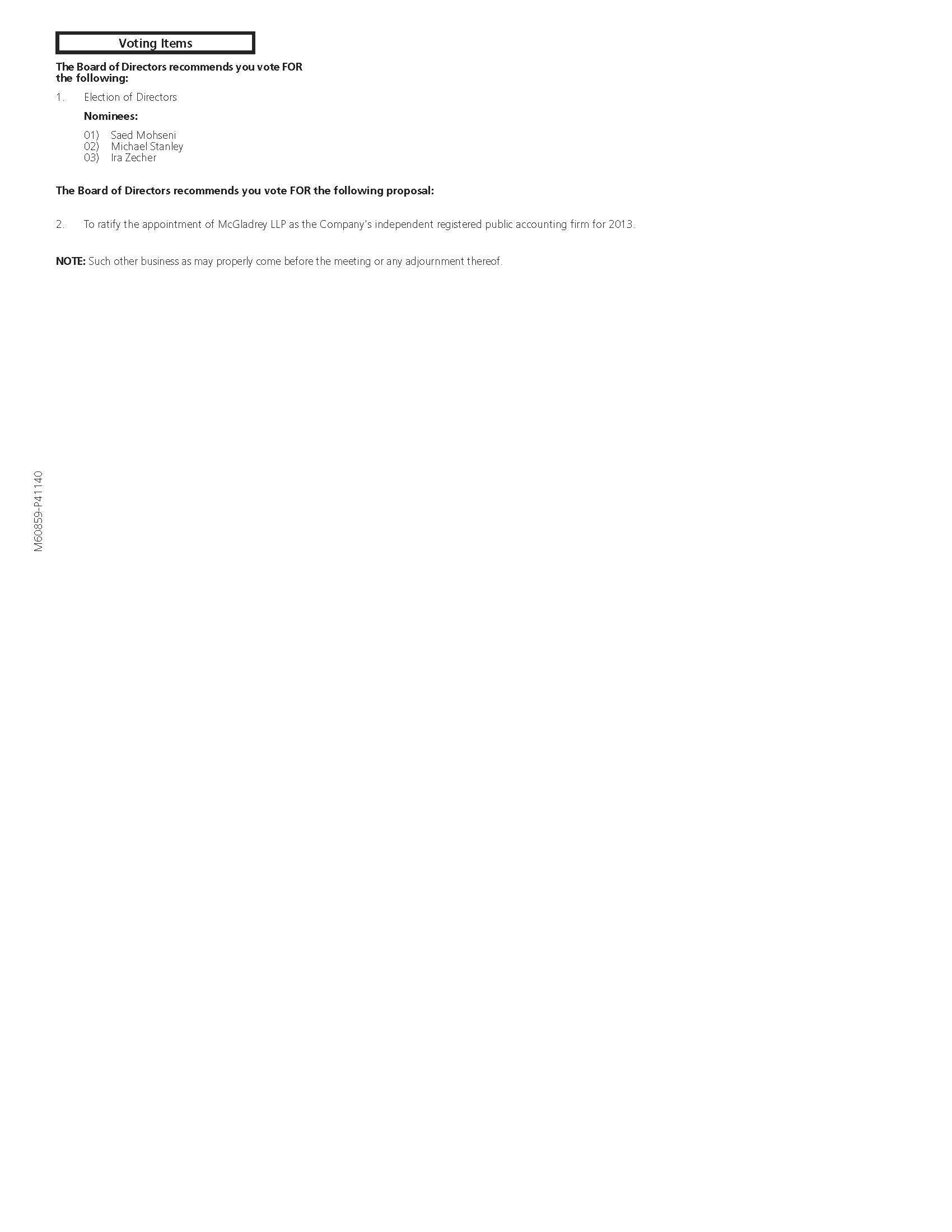

1. | to elect three directors to serve until the 2016 annual meeting of stockholders; |

| |

2. | to ratify the appointment of McGladrey LLP as the Company’s independent registered public accounting firm for 2013; and |

| |

3. | to transact such other business as may properly come before the meeting. |

Information concerning the matters to be voted upon at the meeting is set forth in the accompanying proxy statement. We have also made available the Company’s 2012 annual report. Holders of record of the Company’s common stock as of the close of business on May 30, 2013 are entitled to notice of, and to vote at, the meeting.

Your vote is very important. Whether or not you plan to attend the meeting, please vote using the procedures described on the notice of internet availability of proxy materials or on the proxy card or sign, date and promptly mail a proxy card in the provided pre-addressed, postage-paid envelope.

If you plan to attend the meeting and will need special assistance or accommodation due to a disability, please describe your needs on the enclosed proxy card.

By Order of the Board of Directors,

Sharon Russell

Chief Administrative Officer

and Secretary

Austin, Texas

June 11, 2013

|

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JULY 25, 2013.

The Company’s Notice of Annual Meeting, Proxy Statement and 2012 Annual Report to stockholders are available on the internet at www.proxyvote.com. |

Table of Contents

Page

Chuy’s Holdings, Inc.

1623 Toomey Road

Austin, Texas 78704

PROXY STATEMENT

This proxy statement provides information in connection with the solicitation of proxies by the board of directors of Chuy’s Holdings, Inc. (the “Company”) for use at the Company’s 2013 annual meeting of stockholders or any postponement or adjournment thereof (the “Annual Meeting”). This proxy statement also provides information you will need in order to consider and act upon the matters specified in the accompanying notice of annual meeting. A Notice of Internet Availability of Proxy Materials (the “Notice”) and this proxy statement and proxy card, are being mailed to stockholders on or about June 14, 2013.

Record holders of the Company’s common stock as of the close of business on May 30, 2013 are entitled to vote at the Annual Meeting. Each record holder of common stock on that date is entitled to one vote at the Annual Meeting for each share of common stock held. As of May 30, 2013, there were 16,312,824 shares of common stock outstanding.

You cannot vote your shares unless you are present at the Annual Meeting or you have previously given your proxy. You can vote by proxy in one of three convenient ways:

| |

• | by internet: visit the website shown on your Notice or proxy card and follow the instructions; or |

| |

• | by telephone: dial the toll-free number shown on your proxy card and follow the instructions; or |

| |

• | in writing: sign, date, and return a proxy card in the provided pre-addressed, postage paid envelope. |

You may revoke your proxy at any time prior to the vote at the Annual Meeting by:

| |

• | delivering a written notice revoking your proxy to the Company’s Secretary at the address above; |

| |

• | delivering a new proxy bearing a date after the date of the proxy being revoked; or |

| |

• | voting in person at the Annual Meeting. |

Unless revoked as described above, all properly executed proxies, will be voted at the Annual Meeting in accordance with your directions on the proxy. If a properly executed proxy gives no specific instructions, the shares of common stock represented by your proxy will be voted:

| |

• | FOR the election of the three nominees to serve as directors until the 2016 annual meeting of stockholders; |

| |

• | FOR the ratification of the appointment of McGladrey LLP as the Company’s independent registered public accounting firm for 2013; and |

| |

• | at the discretion of the proxy holders with regard to any other matter that is properly presented at the Annual Meeting. |

If you own shares of common stock held in “street name” and you do not instruct your broker how to vote your shares using the instructions your broker provides you, your shares will be voted in the ratification of the appointment of McGladrey LLP as the Company’s independent registered public accounting firm for 2013, but not for any other proposal. To be sure your shares are voted in the manner you desire, you should instruct your broker how to vote your shares.

Holders of a majority of the outstanding shares of the Company’s common stock must be present, either in person or by proxy, to constitute a quorum necessary to conduct the Annual Meeting. Abstentions and broker non-votes are counted for purposes of determining a quorum and are considered present and entitled to vote.

The following table sets forth the voting requirements, whether broker discretionary voting is allowed and the treatment of abstentions and broker non-votes for each of the matters to be voted on at the Annual Meeting.

|

| | | | | | |

Proposal | | Vote Necessary to Approve Proposal | | Broker Discretionary Voting Allowed? | | Treatment of Abstentions and Broker Non-Votes |

No. 1 - Election of directors | | Plurality (that is, the largest number) of the votes cast | | No | | Abstentions and broker non-votes are not considered votes cast and will have no effect |

No. 2 - Ratification of the appointment of McGladrey LLP | | Affirmative vote of a majority of the shares present, in person or by proxy, at the Annual Meeting and entitled to vote on the matter | | Yes | | Abstentions will have the effect of a vote cast against the matter |

Attendance at the Annual Meeting will be limited to stockholders of record and beneficial owners who provide proof of beneficial ownership as of the record date (such as an account statement, a copy of the voting instruction card provided by a broker, bank, trustee, or nominee, or other similar evidence of ownership).

The Company pays the costs of soliciting proxies. We have engaged Georgeson, Inc. to serve as our proxy solicitor for the Annual Meeting at a base fee of $7,500 plus reimbursement of reasonable expenses. Georgeson will provide advice relating to the content of solicitation materials, solicit banks, brokers, institutional investors, and hedge funds to determine voting instructions, monitor voting, and deliver executed proxies to our voting tabulator. Our employees also may solicit proxies by telephone or in person. However, they will not receive additional compensation for soliciting proxies. The Company may request banks, brokers, and other custodians, nominees, and fiduciaries to forward copies of these proxy materials to the beneficial holders and to request instructions for the execution of proxies. The Company may reimburse these persons for their related expenses. Proxies are solicited to provide all record holders of the Company’s common stock an opportunity to vote on the matters to be presented at the Annual Meeting, even if they cannot attend the meeting in person.

PROPOSAL 1 –

ELECTION OF DIRECTORS

At the Annual Meeting, three directors will be elected to serve three-year terms expiring at our annual stockholders meeting in 2016. This section contains information relating to the three director nominees and the directors whose terms of office continue after the Annual Meeting. The director nominees were selected by the Nominating and Corporate Governance Committee and approved by the board of directors for submission to the stockholders. The nominees for election are Messrs. Mohseni, Stanley and Zecher. All currently serve as directors.

The board of directors recommends a vote “FOR” the election of each of the nominees.

Nominees to be elected for terms expiring at the Annual Meeting in 2016

Saed Mohseni, age 51, has served as a member of our board of directors since September 2012. Mr. Mohseni currently serves as the President and Chief Executive Officer of Bravo Brio Restaurant Group, Inc., the owner and operator of BRAVO! Cucina Italiana and BRIO Tuscan Grille. He was recruited to the Chief Executive Officer position in 2007, assumed the additional role of President in 2009 and led the company through the IPO process in 2010. Additionally, Mr. Mohseni has served as a director of Bravo Brio Restaurant Group, Inc. since 2006. Prior to joining Bravo Brio, Mr. Mohseni worked at McCormick & Schmick for 21 years, where he held positions of increasing responsibility, including serving as a Director from 2004 to 2007 and as Chief Executive Officer from 2000 to 2007. Mr. Mohseni attended Portland State University and Oregon State University. We have concluded that Mr. Mohseni should serve on our board of directors based upon his experience as an executive and board member and his knowledge of the restaurant industry.

Michael Stanley, age 30, has served as a member of our board of directors since May 2011. Mr. Stanley is a Vice President of Goode Partners LLC and was promoted to this position in January 2011. Prior to his promotion, Mr. Stanley was an associate at Goode Partners. He joined Goode Partners in 2006. Prior to working at Goode Partners, Mr. Stanley worked as an analyst at Wachovia Securities. Mr. Stanley currently sits on the board of directors of Rosa Mexicano and is a board observer of Strike Holdings. We have concluded that Mr. Stanley should serve on our board of directors based upon his experience as an investor and his intimate knowledge of our operations.

Ira Zecher, age 60, has served as a member of our board of directors since June 2011. Ira has been a professor at Rutgers University in the Graduate Accounting program since September 2010. From 1974 through December 2010, Ira was employed by Ernst & Young LLP, a registered public accounting firm, retiring as a partner. Previously, he was a senior transaction advisory services partner and Far East private equity leader for Ernst & Young LLP, where he advised clients on mergers and acquisitions across a broad range of industries. Prior to joining the transaction advisory services group, Ira provided accounting, audit and business-advisory services to both public and private clients for Ernst & Young LLP since 1974. He received his Bachelor’s degree from Queens College. He is also a certified public accountant, a member of the American Institute of Certified Public Accountants (AICPA) and the New York State Society of Certified Public Accountants. We have concluded that Ira should serve on our board of directors based upon his extensive professional accounting and financial expertise, which allow him to provide key contributions to the board of directors on financial, accounting, corporate governance and strategic matters.

Current Directors whose terms expire at the Annual Meeting in 2015

Starlette Johnson, age 50, has served as a member of our board of directors since September 2012. Ms. Johnson most recently served as President and Chief Operating Officer, as well as a Director, of Dave & Buster’s, Inc. from 2007 to 2010. Ms. Johnson joined Dave & Buster’s as Chief Strategic Officer in 2006. Prior to joining Dave & Buster’s, Ms. Johnson worked at Brinker International, where she held positions of increasing responsibility, including serving as the Executive Vice President and Chief Strategic Officer. Ms. Johnson is a member of the board of directors and serves on the Audit Committee and the Nominating/Governance Committee for Tuesday Morning, Inc. She also serves on the Advisory Board for the Hospitality & Tourism Program at Virginia Tech and is also a member of the International Women’s Foundation. Ms. Johnson received a B.S. in Finance from Virginia Tech and an M.B.A. from Duke University. We have concluded that Ms. Johnson should serve on our board of directors based upon her experience as an executive and board member and her knowledge of the restaurant industry.

Doug Schmick, age 65, has served on our board of directors since April 2013. Mr. Schmick is a highly respected executive with 40 years of experience in the upscale casual dining segment as a co-founder of McCormick & Schmick’s Seafood Restaurants in 1972. He served on McCormick & Schmick’s board of directors beginning in 2001 and was appointed Chairman in 2004. He also served as Chief Executive Officer of McCormick & Schmick’s from 1974 through 1999, and again from 2007 through 2009. He currently serves on Cheesecake Factory’s board of directors as a member of the Audit Committee. We have concluded that Mr. Schmick should serve on our board of directors based upon his experience as an executive and board member and is knowledge of the restaurant industry.

Michael Young, age 64, is one of our founders. He has served as a member of our board of directors since November 2006. We have concluded that Mr. Young should serve on our board of directors based upon his experience as an investor and operator of restaurant businesses as well as his intimate knowledge of our operations and culture.

Current Directors whose terms expire at the Annual Meeting in 2014

Jose “Joe” Ferreira, Jr., age 57, has served as Chairman of our board of directors since November 2006. Mr. Ferreira is a co-founder and partner of Goode Partners LLC. Prior to the founding of Goode Partners LLC, Mr. Ferreira founded and was President and Chief Executive Officer of Woodclyffe Group, an international business consulting and interim management firm. Prior to founding the Woodclyffe Group in 2001, Mr. Ferreira was Co-Chief Operating Officer, President of Avon International and a member of the board of directors of Avon Products Inc., where he worked for over 20 years. Mr. Ferreira has served on the board of directors of various companies, public and private, and currently sits on the board of directors of Rosa Mexicano, Strike Holdings and Princess House. Mr. Ferreira holds a B.S. from Central Connecticut State University and an M.B.A. from Fordham University. We have concluded that Mr. Ferreira should serve on our board of directors based upon his experience as an executive, investor and board member of other companies.

Steve Hislop, age 53, has served as President, Chief Executive Officer and a member of our board of directors since July 2007. From July 2006 through June 2007, Mr. Hislop was President and Chief Executive Officer of Sam Seltzer Steak House. Prior to that, Mr. Hislop served as the Concept President and a member of the board of directors of O’Charley’s Restaurants for 18 years where he helped grow the business from 12 restaurants to a multi-concept company with 347 restaurants. We have concluded that Mr. Hislop should serve on our board of directors based upon his operational expertise, knowledge of the restaurant industry and leadership experience.

John Zapp, age 60, is one of our founders. He has served as a member of our board of directors since November 2006. We have concluded that John should serve on our board of directors based upon his experience as an investor and operator of restaurant businesses as well as his intimate knowledge of our operations and culture. Mr. Zapp is the brother of Ted Zapp, our Vice President of Operations.

Proposal 2 -

Ratification of Appointment of

McGladrey LLP as the Company’s Independent

Registered Public Accounting Firm for 2013

The audit committee has appointed McGladrey LLP as the Company’s independent registered public accounting firm for 2013. The board of directors is asking stockholders to ratify this appointment. Securities and Exchange Commission (“SEC”) regulations and the Nasdaq listing requirements require the Company’s independent registered public accounting firm to be engaged, retained and supervised by the audit committee. However, the board of directors considers the selection of an independent registered public accounting firm to be an important matter to stockholders. Accordingly, the board of directors considers a proposal for stockholders to ratify this appointment to be an opportunity for stockholders to provide input to the audit committee and the board of directors on a key corporate governance issue.

Representatives of McGladrey LLP are expected to be present at the Annual Meeting and will have the opportunity to make a statement. They will also be available to respond to appropriate questions. For additional information regarding our independent registered public accounting firm, see “Independent Public Accountants.”

The board of directors recommends a vote “FOR” the ratification of McGladrey LLP as the Company’s independent registered public accounting firm.

The Board, Its Committees and Its Compensation

Board of Directors

The board of directors presently consists of nine members, eight of whom are non-employee directors. The board of directors is divided into three classes, with each class serving three-year terms. The term of one class expires at each annual meeting of stockholders.

Director Compensation

The elements of compensation payable to our non-employee directors in 2012 are briefly described in the following table.

|

| | | |

Board Service: | |

Annual cash retainer | $ | 30,000 |

|

Initial Grant of Stock Options | 7,250 shares |

|

Board Committee Service: | |

Audit Committee Chair annual cash retainer | $ | 10,000 |

|

Prior to our initial public offering, our board of directors did not historically receive compensation. Upon the completion of our initial public offering, we implemented a compensation plan for our board of directors. Our independent directors receive compensation for their services as directors. Committee chairs, except for the audit committee chair, do not receive additional compensation for serving as chair. We reimburse directors for all expenses incurred in attending board meetings.

Grants of stock options to new members of our board of directors are made under the Chuy’s Holdings, Inc. 2012 Omnibus Equity Incentive Plan. These stock options will vest 20% on each of the first five anniversaries of the grant date.

Our compensation committee is considering engaging a compensation consultant to assist the committee in evaluating its director compensation program.

Director Compensation Table

The following table provides information regarding the compensation of our non-employee directors for the year ended December 30, 2012.

|

| | | | | | | | | | | | |

NAME | | FEES EARNED OR PAID IN CASH | | STOCK AWARDS (1) | | TOTAL |

Jose Ferreira, Jr. | | $ | — |

| | $ | — |

| | $ | — |

|

Starlette Johnson | | 7,500 |

| | 58,924 |

| | 66,424 |

|

Saed Mohseni | | 7,500 |

| | 58,924 |

| | 66,424 |

|

David Oddi (2) | | — |

| | — |

| | — |

|

Michael Stanley | | — |

| | — |

| | — |

|

Mike Young | | — |

| | — |

| | — |

|

John Zapp | | — |

| | — |

| | — |

|

Ira Zecher | | 40,000 |

| | — |

| | 40,000 |

|

| |

(1) | The grant date fair value of each award, calculated in accordance with the Financial Accounting Standards Board’s (“FASB”) Accounting Standards Codification (“ASC”) Topic 718 (“Topic 718”), was $8.13. Pursuant to SEC rules, the amounts shown in this column exclude the impact of estimated forfeitures related to service-based vesting conditions. See Note 10 to our consolidated financial |

statements included in our Annual Report on Form 10-K for the year ended December 30, 2012 for information regarding the assumptions made in determining these values.

| |

(2) | Mr. Oddi resigned from our board of directors on April 25, 2013. |

Director Independence and Controlled Company Status

Our board of directors will review at least annually the independence of each director. During these reviews, the board will consider transactions and relationships between each director (and his or her immediate family and affiliates) and our company and its management to determine whether any such transactions or relationships are inconsistent with a determination that the director is independent. This review will be based primarily on responses of the directors to questions in a directors’ and officers’ questionnaire regarding employment, business, familial, compensation and other relationships with the Company and our management. Our board of directors has determined that each of Ira Zecher, Starlette Johnson, Saed Mohseni and Doug Schmick are independent. As required by the Nasdaq Global Select Market, our independent directors will meet in regularly scheduled executive sessions at which only independent directors are present. We intend to comply with future governance requirements to the extent they become applicable to us.

On January 30, 2013, certain of our stockholders sold shares of our common stock in a registered public offering. Following the completion of the secondary offering in January 2013, we were no longer able to avail ourselves of the controlled company exception under the Nasdaq Marketplace Rules. Accordingly, we are required to have a majority of independent directors on our board of directors and a compensation committee and nominating and corporate governance committee composed entirely of independent directors as defined under the Nasdaq Marketplace Rules, subject to a phase-in period of one year following the loss of our controlled company status. Under the Nasdaq listing requirements, a company that ceases to be a controlled company must comply with the independent board committee requirements as they relate to the compensation and nominating and corporate governance committees on the following phase-in schedule: (1) one independent committee member at the time it ceases to be a controlled company, (2) a majority of independent committee members within 90 days of the date it ceases to be a controlled company and (3) all independent committee members within one year of the date it ceases to be a controlled company. Additionally, the Nasdaq listing requirements provide a 12-month phase-in period from the date a company ceases to be a controlled company to comply with the majority independent board requirement. The loss of our controlled company status does not modify the independence requirements for the audit committee under the phase-in period following our initial public offering, or IPO.

We intend to continue our compliance with the phase-in requirements of Sarbanes-Oxley and the Nasdaq Marketplace Rules, which require our audit committee be composed of at least three members, each of whom is required to be independent, by July 24, 2013. We currently are in compliance with the audit committee phase-in requirements and have a fully independent audit committee. Ira Zecher, Starlette Johnson and Saed Mohseni serve on our audit committee and are independent. We have a majority of independent directors on each of our compensation committee and nominating and corporate governance committee. Our board of directors intends to take all action necessary to continue to comply with the Nasdaq Marketplace Rules with respect to our compensation committee and nominating and corporate governance committee, subject to the permitted phase-in period, and to continue our compliance with the requirements of Sarbanes-Oxley and the Nasdaq Marketplace Rules with respect to our audit committee.

Corporate Governance

We believe that good corporate governance is important to ensure that, as a public company, we will be managed for the long-term benefit of our stockholders. We and our board of directors have been reviewing the corporate governance policies and practices of other public companies, as well as those suggested by various authorities in corporate governance. We have also considered the provisions of the Sarbanes-Oxley Act and the rules of the SEC and the Nasdaq Global Select Market.

Based on this review, we have established and adopted, charters for the audit committee, compensation committee and nominating and corporate governance committee, as well as a code of business conduct and ethics applicable to all of our directors, officers and employees.

Our committee charters, code of business conduct and ethics and corporate governance guidelines are available on our website (www.chuys.com) in the Investors section. Copies of these documents are also available upon written request to our Corporate Secretary. We will post information regarding any amendment to, or waiver from, our code of business conduct and ethics on our website in the Investors section.

The board of directors periodically reviews its corporate governance policies and practices. Based on these reviews, the board of directors may adopt changes to policies and practices that are in our best interests and as appropriate to comply with any new SEC or Nasdaq Marketplace Rules.

Board Leadership Structure and Board’s Role in Risk Oversight

Joe Ferreira, a non-employee, serves as Non-Executive Chairman of our board of directors. We support separating the position of Chief Executive Officer and Chairman to allow our Chief Executive Officer to focus on our day-to-day business, while allowing the Chairman to lead our board of directors in its fundamental role of providing advice to, and oversight of, management. Our board of directors recognizes the time, effort and energy that the Chief Executive Officer is required to devote to his position in the current business environment, as well as the commitment required to serve as our Chairman, particularly as our board of directors’ oversight responsibilities continue to grow. Our board of directors also believes that this structure ensures a greater role for the non-management directors in the oversight of our company and establishing priorities and procedures for the work of our board of directors.

While our amended and restated bylaws do not require that our Chairman and Chief Executive Officer positions be separate, our board of directors believes that having separate positions and having a non-employee director serve as Chairman is the appropriate leadership structure for us at this time and demonstrates our commitment to good corporate governance.

Risk is inherent with every business and we face a number of risks. Management is responsible for the day-to-day management of risks we face, while our board of directors, as a whole and through our audit committee, is responsible for overseeing our management and operations, including overseeing its risk assessment and risk management functions. Our board of directors has delegated responsibility for reviewing our policies with respect to risk assessment and risk management to our audit committee through its charter. Our board of directors has determined that this oversight responsibility can be most efficiently performed by our audit committee as part of its overall responsibility for providing independent, objective oversight with respect to our accounting and financial reporting functions, internal and external audit functions and systems of internal controls over financial reporting and legal, ethical and regulatory compliance. Our audit committee will regularly report to our board of directors with respect to its oversight of these areas.

Board Meetings

The board of directors held 4 meetings during 2012. Each director serving on the board of directors in 2012 attended at least 75% of the total number of meetings of the board of directors and committees on which they served during the time they served on the board of directors. Under our corporate governance guidelines, each director is expected to devote the time necessary to appropriately discharge his responsibilities and to rigorously prepare for, attend and participate in all board of directors meetings and meetings of committees on which he serves.

Annual Meetings of Stockholders

The Company’s directors are encouraged to attend our annual meeting of stockholders, but we do not currently have a policy relating to directors’ attendance at these meetings. This will be our first annual meeting of stockholders since we completed our initial public offering in July 2012.

Board Committees

Our board of directors has three standing committees: an audit committee, a compensation committee and a nominating and corporate governance committee. The composition and responsibilities of each committee are described below. Members will serve on these committees until their resignation or until otherwise determined by our board of directors.

Audit Committee

Our audit committee is a standing committee of our board of directors. The functions of our audit committee include:

| |

• | appointing and determining the compensation for our independent auditors; |

| |

• | establishing procedures for the receipt, retention and treatment of complaints regarding internal accounting controls; and |

| |

• | reviewing and overseeing our independent registered public accounting firm. |

Our audit committee currently consists of Ira Zecher, Starlette Johnson and Saed Mohseni, with Ira Zecher serving as chairman. From the time of our IPO through the end of 2012, the audit committee formally met once in addition to other informal discussions. The SEC and the Nasdaq Marketplace rules required us to have one independent audit committee member upon the listing of our common stock on the Nasdaq Global Select Market, and a majority of independent audit committee members within 90 days from the date of listing. We also are required to have all independent audit committee members within one year from the date of our original listing. Currently, all of our audit committee members are independent. We are also required to have at least one audit committee financial expert. Our board of directors has determined that each of Ira Zecher, Saed Mohseni and Starlette Johnson is an audit committee financial expert.

Our board of directors has adopted a written charter under which the audit committee operates. A copy of the charter, which satisfies the applicable standards of the SEC and the Nasdaq Global Select Market, is available on our website. The audit committee has the authority to engage independent counsel and other advisors as the committee deems necessary to carry out its duties.

Compensation Committee

Our compensation committee is a standing committee of our board of directors. The compensation committee’s functions include:

| |

• | reviewing and recommending to our board of directors the salaries and benefits for our executive officers; |

| |

• | recommending overall employee compensation policies; and |

| |

• | administering our equity compensation plans. |

Our compensation committee currently consists of Joe Ferreira, Saed Mohseni, Doug Schmick and Ira Zecher, with Joe Ferreira serving as chairman. We are no longer able to avail ourselves of the controlled company exception under the Nasdaq Marketplace Rules. As a result, we are required to have a compensation committee composed entirely of independent directors as defined under the Nasdaq Marketplace Rules, subject to a phase-in period. As part of the phase-in requirements, the Nasdaq Marketplace Rules required that this committee have at least one independent director at the time of completion of the secondary offering that was completed in January 2013 and a majority of independent directors by April 30, 2013. Our board of directors intends to take all action necessary to comply with the Nasdaq Marketplace Rules with respect to our compensation committee, subject to the permitted phase-in period.

From the time of our IPO though the end of 2012, the compensation committee formally met two times. Our board of directors has determined Mr. Mohseni, Mr. Schmick and Mr. Zecher are independent under the Nasdaq Marketplace Rules.

Our board of directors has adopted a written charter under which the compensation committee operates. A copy of the charter, which satisfies the applicable standards of the SEC and the Nasdaq Global Select Market, is available on our website. The compensation committee has the sole authority to retain and terminate compensation consultants to assist in the evaluation of director or executive officer compensation and the sole authority to approve the fees and other retention terms of such compensation consultants. The compensation committee may also retain independent counsel and other independent advisors to assist it in carrying out its responsibilities.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee is a standing committee of our board of directors. The functions of our nominating and corporate governance committee include:

| |

• | identifying individuals qualified to serve as members of our board of directors; |

| |

• | recommending to our board nominees for our annual meetings of stockholders; |

| |

• | evaluating our board’s performance; |

| |

• | developing and recommending to our board corporate governance guidelines; and |

| |

• | providing oversight with respect to corporate governance and ethical conduct. |

Our nominating and corporate governance committee consists of Starlette Johnson, Doug Schmick and John Zapp, with John Zapp serving as the committee chairman. We are no longer able to avail ourselves of the controlled company exception under the Nasdaq Marketplace Rules. As a result, we are required to have a nominating and corporate governance committee composed entirely of independent directors as defined under the Nasdaq Marketplace Rules, subject to a phase-in period. As part of the phase-in requirements, the Nasdaq Marketplace Rules required that this committee have at least one

independent director at the time of completion of the secondary offering that was completed in January 2013 and a majority of independent directors by April 30, 2013. Our board of directors will take all action necessary to comply with the Nasdaq Marketplace Rules with respect to our nominating and corporate governance committee, subject to the permitted phase-in period.

From the time of our IPO through the end of 2012, the nominating and corporate governance committee did not meet formally, however, the committee did take action by written consent. Our board of directors has determined that Ms. Johnson and Mr. Schmick are independent under the Nasdaq Marketplace Rules.

Our board of directors has adopted a written charter under which the nominating and corporate governance committee will operate. A copy of the charter, which satisfies the applicable standards of the SEC and the Nasdaq Global Select Market, is available on our website. The nominating and corporate governance committee has the sole authority to retain and terminate any search firm to assist in the identification of director candidates and the sole authority to set the fees and other retention terms of such search firms. The committee may also retain independent counsel and other independent advisors to assist it in carrying out its responsibilities.

Other Committees

Our board of directors may establish other committees as it deems necessary or appropriate from time to time.

Compensation Committee Interlocks and Insider Participation

None of our executive officers have served as a member of the board of directors or compensation committee of any related entity that has one or more executive officers serving on our board of directors or compensation committee.

Code of Business Conduct and Ethics

We have adopted a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, and persons performing similar functions. A current copy of the code is posted on our website, which is located at www.chuys.com. Any amendments to our code of conduct will be disclosed on our website promptly following the date of such amendment or waiver.

Qualifications for Director Nominees

The nominating and corporate governance committee is responsible for reviewing with the board of directors, at least annually, the appropriate skills and experience required for members of the board of directors. This assessment includes factors such as judgment, skill, diversity, integrity, experience with businesses and other organizations of comparable size, the interplay of the candidate’s experience with the experience of other board members, and the extent to which the candidate would be a desirable addition to the board of directors and any committees of the board of directors.

Director Candidate Recommendations by Stockholders

The nominating and corporate governance committee intends to adopt a formal policy regarding the consideration of director nominations by stockholders. The committee will review and evaluate any director nominations submitted by stockholders, including reviewing the qualifications of, and making

recommendations to the board of directors regarding, director nominations submitted by stockholders. See “Communications with the Board of Directors” below for additional information on how to submit a director nomination to the board of directors.

Communications with the Board of Directors

Any stockholder or other interested party who wishes to communicate directly with the board of directors or any of its members may do so by writing to: Corporate Secretary, Chuy’s Holdings, Inc., 1623 Toomey Road, Austin, TX, 78704. The mailing envelope should clearly indicate whether the communication is intended for the board of directors as a group, the non-employee directors or a specific director.

Executive Officers

The following sets forth information regarding the executive officers of the Company as of June 11, 2013:

|

| | | | |

NAME | | AGE | | POSITIONS |

Steve Hislop | | 53 | | Director, President and Chief Executive Officer |

Jon Howie | | 45 | | Vice President and Chief Financial Officer |

Sharon Russell | | 57 | | Secretary and Chief Administrative Officer |

Frank Biller | | 56 | | Vice President of Operations, Southeast Region |

Michael Hatcher | | 52 | | Vice President of Real Estate and Development |

Ted Zapp | | 61 | | Vice President of Operations |

Information regarding Mr. Hislop is included above under “Election of Directors.”

Jon Howie has served as our Chief Financial Officer since August 2011 and as Vice President since April 2013. From March 2007 to July 2011, Jon served as the Chief Financial Officer of Del Frisco’s Restaurant Group, LLC. Prior to that, he served 5 years as Controller and was then promoted to Chief Accounting Officer of the Lone Star Steakhouse & Saloon, Inc. Jon is a certified public accountant and prior to joining Lone Star Steakhouse & Saloon, Inc. was employed as an audit senior manager with Grant Thornton, LLP for one year and held various audit positions, including audit senior manager, at Ernst & Young LLP for ten years. At Grant Thornton and Ernst and Young, he served as an accounting and business advisor to both private and public companies and advised a number of these companies in conjunction with their initial and secondary public offerings.

Sharon Russell has served as our Secretary and Chief Administrative Officer since August 2011. Prior to becoming our Chief Administrative Officer, she supervised our accounting department from 1987 to 2006 and served as our Chief Financial Officer from 2006 to August 2011.

Frank Biller has served as our Vice President of Operations for the Southeast Region since July 2008. Prior to joining us, Frank spent 18 years as the Vice President of Operations for O’Charley’s Restaurants with overall responsibility for 240 restaurants in 19 states.

Michael Hatcher has served as our Vice President of Real Estate and Development since November 2009. Michael joined Chuy’s as a restaurant manager in 1987 and was promoted to General Manager from 1989 to 2002. He was Director of Purchasing and Real Estate from 2002 to 2009.

Ted Zapp has served as our Vice President of Operations since November 2006. Ted has worked with us for almost 30 years. He worked in restaurant operations as a General Manager from 1992 to 1996 and was promoted to Operations Supervisor from 1996 to 2003. He was promoted to Director of Operations from 2003 to 2006 before assuming his current position. Ted Zapp is the brother of John Zapp, a member of our board.

Executive Compensation

Introduction

This compensation discussion provides an overview of our executive compensation program, together with a description of the material factors underlying the decisions that resulted in the compensation provided to our chief executive officer, chief financial officer and our three other highest paid executive officers during fiscal year 2012 (collectively, the “named executive officers”), as presented in the tables which follow this discussion. This discussion contains statements regarding our performance targets and goals. These targets and goals are disclosed in the limited context of our compensation program and should not be understood to be statements of management’s expectations or estimates of financial results or other guidance. We specifically caution investors not to apply these statements to other contexts.

Objective of Compensation Policy

The objective of our compensation policy is to provide a total compensation package to each named executive officer that will enable us to:

| |

• | attract, motivate and retain outstanding individuals; |

| |

• | reward named executive officers for performance; and |

| |

• | align the financial interests of each named executive officer with the interests of our stockholders to encourage each named executive officer to contribute to our long-term performance and success. |

Overall, our compensation program is designed to reward both individual and company performance. A significant portion of each of our named executive officers’ annual compensation is comprised of discretionary and performance-based bonuses. While we have not used significant amounts of equity‑based compensation in the past, we intend to increase our use of long-term incentives to reward long-term company and individual performance and to promote retention through delayed vesting of awards.

Administration

Since our acquisition by Goode Partners in 2006, our board of directors has administered and determined overall compensation for our named executive officers. Under our stockholders agreement, Goode Partners has appointed a majority of the board of directors since 2006. While these rights terminated upon consummation of our IPO, Goode Partners has held a majority of the voting power over our common stock since the IPO. However, Goode Partners no longer holds a majority of the voting power over our common stock and, as a result, we are no longer able to avail ourselves of the controlled company exception under the Nasdaq Marketplace Rules and will be required to have an independent compensation committee determine our named executive officers’ compensation, subject to the permitted phase-in period. Additionally, after becoming subject to Section 162(m) of the Internal Revenue Code (the “Code”), we will appoint three independent directors to our compensation committee who each qualify as outside directors to the extent necessary to maintain the deductibility of compensation we pay.

Our compensation committee oversees our executive compensation program and is responsible for approving the nature and amount of the compensation paid to, and any employment and related agreements entered into with our named executive officers. The committee also administers our equity compensation plans and awards.

Process for Setting Total Compensation

In the past, at the first meeting of each new fiscal year, our board of directors has set annual base salaries, determined the amount of discretionary and performance-based bonuses for the prior year and set performance criteria for our performance-based bonuses for the following year. In making these compensation decisions, our board of directors has considered the recommendations of our chief executive officer, particularly with respect to the performance of our named executive officers.

When hiring named executive officers, our board of directors has set their compensation based on the individuals’ position and responsibilities and their compensation package at their previous company. At the time of hire, we have granted equity awards to new executives at a level that the board of directors believes is appropriate to motivate that named executive officer to accomplish the individual goals for their position as well as our company objectives. For new named executive officers, bonuses are pro rated based on the portion of the year during which the executive was employed by us.

During its annual review process, our board of directors has set compensation for each named executive officer at a level we believe is appropriate considering each named executive officer’s annual review, level of responsibility, the awards and compensation paid to the named executive officer in past years and progress toward or attainment of previously set personal and corporate goals and objectives, including attainment of financial performance goals and such other factors as the board has deemed appropriate and in our best interests and the best interests of our stockholders. The board has given different weight at different times to different factors for each named executive officer. Our performance criteria are discussed more fully below under the heading “-Bonus Compensation-Performance-Based Bonus.” Other than with respect to our performance-based bonuses, the board has not relied on predetermined formulas or a limited set of criteria when it evaluates the performance of our named executive officers.

Our compensation committee undertakes the same process as our board of directors has in the past. Our chief executive officer will continue to provide recommendations to our compensation committee with respect to salary adjustments, discretionary and performance-based bonus targets and awards and equity incentive awards for the named executive officers that report to him. Our compensation committee will meet with our chief executive officer at least annually to discuss and review his recommendations for compensation of our executive officers, excluding himself. When making individual compensation decisions for our named executive officers, the compensation committee will take many factors into account, including the officer’s experience, responsibilities, management abilities and job performance, our performance as a whole, current market conditions and competitive pay levels for similar positions at comparable companies. These factors will be considered by the compensation committee in a subjective manner without any specific formula or weighting.

Our compensation committee is considering engaging a compensation consultant to assist the committee in evaluating its executive compensation program.

Elements of Compensation

Our compensation program for named executive officers consists of the following elements of compensation, each described in greater depth below:

| |

• | Discretionary and performance-based bonuses. |

| |

• | Equity-based incentive compensation. |

| |

• | Severance and change-in-control benefits. |

We may, from time to time, enter into written agreements to reflect the terms and conditions of employment of a particular named executive officer, whether at the time of hire or thereafter. We consider entering into these agreements when it serves as a meaningful recruitment and retention mechanism. We currently have employment agreements in place with Messrs. Hislop, Howie, Biller, Hatcher and Zapp and Mrs. Russell. See “Employment Agreements” for additional information regarding our executive officer’s employment agreements.

Base Salary

|

| | |

NAME | | 2012 SALARY ($) (1) |

Steve Hislop | | 395,000 |

Jon Howie | | 250,000 |

Sharon Russell | | 180,000 |

Frank Biller | | 170,000 |

Michael Hatcher | | 160,000 |

Ted Zapp | | 180,000 |

| |

(1) | Represents each officer’s annual base salary assuming service with us for the entire fiscal year. |

We pay base salaries to attract, recruit and retain qualified employees. Our compensation committee will review and set base salaries of our named executive officers annually. These salary levels are and will continue to be set based on the named executive officer’s experience and performance with previous employers and negotiations with individual named executive officers. The compensation committee may increase base salaries each year based on its subjective assessment of our company’s and the individual executive officer’s performance and each named executive officer’s experience, length of service and changes in responsibilities. The weight given such factors by the compensation committee may vary from one named executive officer to another.

In the first quarter of 2012, our named executive officers received an average pay increase of approximately 6%. The board of directors determined that these raises were appropriate in light of company and individual performance, increases in individual responsibilities and the role of salary in our named executive officers’ compensation package.

Bonus Compensation

|

| | | | | | | | | | |

| | PERFORMANCE-BASED BONUS |

NAME | | DISCRETIONARY AWARD ($) | | THRESHOLD AWARD ($) | | TARGET AWARD ($) | | MAXIMUM AWARD ($) | | ACTUAL AWARD ($) |

Steve Hislop | | 1,000 | | — | | 197,500 | | 395,000 | | 395,000 |

Jon Howie | | 1,000 | | — | | 125,000 | | 250,000 | | 250,000 |

Sharon Russell | | 1,000 | | — | | 54,000 | | 108,000 | | 108,000 |

Frank Biller | | 1,000 | | — | | 51,000 | | 102,000 | | 102,000 |

Michael Hatcher | | 1,000 | | — | | 48,000 | | 96,000 | | 96,000 |

Ted Zapp | | 1,000 | | — | | 54,000 | | 108,000 | | 108,000 |

Performance-Based Bonus

In line with our strategy of rewarding performance, our executive compensation program includes performance-based bonuses to named executive officers. Our board of directors has and our compensation committee intends to continue to establish annual target performance-based bonuses for each named executive officer during the first quarter of the year.

The target and maximum performance-based bonuses have been set at levels our board of directors believes will provide a meaningful incentive to achieve company and individual goals and contribute to our financial performance. In 2012, the target and maximum performance-based bonus that each named executive officer could receive were set at 50% and 100%, respectively, of our Chief Executive Officer’s and Chief Financial Officer’s annual base salary and 30% and 60%, respectively, of our other named executive officers’ annual base salaries. No bonus is paid if actual Company Adjusted EBITDA is 95% or less of budget Company Adjusted EBITDA. To the extent that actual Company Adjusted EBITDA exceeds 95% of budget Company Adjusted EBITDA, the plan provides that we will pay a bonus based on where performance falls on a linear basis between 95% and 100% of budget Company Adjusted EBITDA and between 100% and 110% of budget Company Adjusted EBITDA. In each circumstance, the board retained its discretion to adjust the amount paid under the plan based on individual and company circumstances. Our performance-based bonuses are determined based 80% on Company Adjusted EBITDA (as discussed below) and 20% on performance with respect to individual goals, such as improving or maintaining compliance with procedures, reporting and training goals.

If our budget Company Adjusted EBITDA is achieved, each individual will earn 80% of their target bonus. The remaining 20% of target bonus is determined based on the extent to which each named executive officer achieves two to four individual goals for the year.

The Company Adjusted EBITDA portion of this bonus is determined based primarily on the extent to which we achieve our budget Company Adjusted EBITDA goal. Company Adjusted EBITDA is our earnings before interest, taxes, depreciation and amortization plus any loss on sales of asset (less any gain on a sale of assets); banking amendment and legal fees; stock-based compensation; restaurant pre-opening costs; management fees; reimbursable board of directors fees; interest income; and certain non-cash adjustments. For each 1.0% that actual Company Adjusted EBITDA is above or below budget Company Adjusted EBITDA, the percentage of the target they receive will increase by 10% or decrease by 20%, respectively, of the Company Adjusted EBITDA portion of their target bonus. For example, if actual Company Adjusted EBITDA is 1% above budget Company Adjusted EBITDA, the named executive officers will receive 1.1 times 80% of their target bonus. The maximum a named executive officer may receive for Company Adjusted EBITDA performance is 2.0 times 80% of their target bonus. We use our

Company Adjusted EBITDA, together with financial measures prepared in accordance with GAAP, such as revenue, net income and cash flows from operations, to assess our historical and prospective operating performance and to enhance our understanding of our core operating performance. We also use our Company Adjusted EBITDA internally to evaluate the performance of our personnel and also as a benchmark to evaluate our operating performance or compare our performance to that of our competitors. The use of our Company Adjusted EBITDA as a performance measure permits a comparative assessment of our operating performance relative to our performance based on our GAAP results, while isolating the effects of some items that vary from period to period without any correlation to core operating performance or that vary widely among similar companies. For the portion of the performance-based bonus that is based on the extent of the achievement of company and individual goals, our board has determined the percentage of the goals that were achieved and multiplies that percentage by the amount of the bonus based on those metrics. The compensation committee determined that all the named executive officers were to receive the maximum payout based on the achievement of Company and individual performance goals and the additional effort required by the named executive officers during 2012 to run the business and complete a refinancing transaction, an initial public offering and begin work on a secondary offering. That bonus amount is then multiplied by the multiplier applied to the Company Adjusted EBITDA portion of the bonus.

Target, maximum and actual performance-based bonuses for 2012 for each of the named executive officers are shown in the table above and in the “Non-Equity Incentive Plan Compensation” column of the Summary Compensation Table. Prior to the consummation of our IPO, we adopted a new cash bonus plan, which complies with Section 162(m) of the Code.

Discretionary Bonus

While our board of directors has not and our committee does not intend to regularly pay discretionary bonuses, during consideration of compensation for 2011 performance, our board of directors determined to award discretionary bonuses based on each named executive officer’s performance and accomplishments during the year. Historically, each of our named executive officers has also received a $1,000 holiday bonus each December. The discretionary bonuses awarded to our named executive officers in 2012 are set forth in the table above.

In June 2011, we paid a special one-time cash bonus to management that at the time of the bonus held vested options. We granted this bonus in connection with entering into our old credit facility to incentivize management to consummate the refinancing and continue to pursue our performance objectives.

Equity Compensation

We pay equity-based compensation to our named executive officers because it links our long-term results achieved for our stockholders and the rewards provided to named executive officers, thereby ensuring that such officers have a continuing stake in our long-term success.

Historically, we have granted equity awards to our named executive officers in conjunction with significant transactions and in conjunction with a named executive officer’s initial hire or promotion to an executive position. We have provided this equity compensation to reward performance as well as to promote retention through delayed vesting. We believe that by weighting total compensation in favor of discretionary and performance-based bonuses, we have appropriately rewarded individual achievement while at the same time providing incentives to promote company performance. In the future, we plan to increase our use of long-term equity incentives, particularly through grants of stock options under our 2012 Omnibus Equity Incentive Plan (the “2012 Plan”), to further align the interests of our executives

with those of stockholders. In addition to stock options, the 2012 Plan provides for the issuance of share appreciation rights, restricted shares, deferred shares, performance shares and other share based awards. In the future, we may consider granting other forms of equity to our named executive officers. For additional information regarding our 2012 Plan, see “-2012 Omnibus Equity Incentive Plan.”

During 2010, we granted Michael Hatcher stock options for the purchase of up to 16,312 shares of our common stock in connection with his promotion to Vice President of Real Estate Development and to bring his compensation in line with the compensation of our other named executive officers.

We adopted the 2012 Plan as insufficient shares were available under the 2006 Stock Option Plan (the “2006 Plan”), which was adopted in November 2006, in order to provide an incentive to employees selected by the board of directors for participation. In conjunction with our reverse stock split and in accordance with the 2006 Plan, we adjusted the exercise price of and the number of shares subject to our outstanding equity awards to reflect the 2.7585470602469:1 reverse stock split. In connection with the adoption of the 2012 Plan, we terminated the 2006 Plan, and no further awards will be granted under the 2006 Plan. The termination of the 2006 Plan will not affect awards outstanding under the 2006 Plan at the time of its termination and the terms of the 2006 Plan will continue to govern outstanding awards granted under the 2006 Plan.

Options granted after 2006 held by each of the named executive officers (and certain of our other salaried employees) ordinarily vest ratably over a period of five years, subject to the applicable named executive officer remaining employed through each vesting date. The equity awards granted to our named executive officers in 2006 vest with respect to 60%, 20% and 20% of the shares subject to the awards on the third, fourth and fifth anniversaries, respectively, of the date of grant of the awards. We believe that the delayed vesting terms promote retention.

We will make grants of stock options to the current named executive officers and other employees under the 2012 Plan. We will make these grants to the current named executive officers and other employees because we believe that we should provide our employees an opportunity to share in our success provided they continue to contribute to our success.

Severance and Transaction-Based Benefits

We currently have employment agreements in place with Messrs. Hislop, Howie, Biller, Hatcher and Zapp and Mrs. Russell that provide termination or severance benefits. We agreed to pay termination or severance benefits in the event of an executive’s termination by us without cause as a retention incentive and, in Mr. Howie’s case, as a recruitment incentive. We believe this level of severance benefit provides our executives with the assurance of security if their employment is terminated for reasons beyond their control. For additional information on the severance benefits provided under the employment agreements with our executive officers see “-Employment Agreements.”

In the event of a termination of one of our named executive officers that does not have an agreement with us regarding termination or severance, any termination or severance benefits would be determined on a case-by-case basis.

Upon a change in control, our named executive officers’ equity awards granted under the 2006 Plan would vest.

The amount each named executive would be entitled to receive in the event of a termination is reported below under the heading “-Potential Payments upon Termination or Change in Control.”

Perquisites

In 2012, we provided complimentary dining as a personal-benefit perquisite to named executive officers. The aggregate incremental cost to us of the perquisites received by each of the named executive officers in 2012 did not exceed $10,000 and, accordingly, this benefit is not included in the Summary Compensation Table below. We provide the named executive officers with complimentary dining privileges at our restaurants. We view complimentary dining privileges as a meaningful benefit to our named executive officers as it is important for named executive officers to experience our products and services in order to better perform their duties for us.

General Benefits

We provide a limited number of personal benefits to our named executive officers. Our named executive officers participate in our health and benefit plans, and are entitled to vacation and paid time off based on our general vacation policies.

The following are standard benefits offered to all of our eligible employees, including the named executive officers.

Retirement Benefits. We maintain a tax-qualified 401(k) savings plan. Employees are eligible after one year of service and may defer up to the maximum amount allowable by the IRS.

Medical, Dental, Life Insurance and Disability Coverage. Active employee benefits such as medical, dental, life insurance and disability coverage are available to all eligible employees, including our named executive officers.

Moving Costs. We will reimburse out-of-pocket moving expenses for eligible executive officers in conjunction with their hiring.

Other Paid Time Off Benefits. We also provide vacation and other paid holidays to all employees, including the named executive officers, which we believe are appropriate for a company of our size and in our industry.

Employment Agreements

We entered into employment agreements with Messrs. Hislop, Howie, Biller, Hatcher and Zapp and Mrs. Russell. The employment agreements do not provide for a fixed term.

The employment agreements provide that Messrs. Hislop, Howie, Biller, Hatcher, Zapp and Mrs. Russell, will receive an annual base salary of at least $366,608, $250,000, $162,692, $149,205, $167,094 and $167,094, respectively. Mr. Hislop and Mr. Howie are each eligible to receive a target annual bonus of 50% of their annual base salary, based upon the achievement of goals and objectives determined by our Compensation Committee with a minimum and maximum bonus of 0% and 100% of their annual base salary, respectively. Messrs. Biller, Hatcher and Zapp and Mrs. Russell are each eligible to receive a target annual bonus of 30% of their annual base salary, based upon the achievement of goals and objectives determined by our Compensation Committee with a minimum and maximum bonus of 0% and 60% of their annual base salary respectively. The employment agreements provide that each executive will be eligible to participate in employee plans, including 401(k), medical and dental plans, made available to our other senior executives generally.

Mr. Howie’s employment agreement entitled him to receive an option to purchase up to 48,938 shares of the Company’s common stock. In satisfaction of this provision of Mr. Howie’s employment agreement, on April 10, 2012, we granted Mr. Howie an option to purchase up to 48,938 shares of the Company’s common stock. In addition, in connection with his employment agreement, Mr. Howie purchased 8,489 shares of the Company’s common stock.

Each employment agreement provides for severance benefits if the executive’s employment is terminated without cause (as defined in the employment agreement), subject to the executive’s compliance with certain confidentiality, non-compete, non-solicitation and non-disparagement obligations and the execution of a general release of claims. In the event Mr. Hislop’s employment is terminated without cause, he is entitled to continue to receive his base salary for two years following the termination of his employment. In the event that Messrs. Howie, Biller, Hatcher and Zapp or Mrs. Russell, is terminated, each is entitled to continue to receive one year’s base salary following their termination. In the event of termination, all of our executive officers are entitled to continue to receive the amount that the Company was subsidizing for the executive and his or her dependents’ medical and dental insurance coverage during the same period the executive is entitled to continue to receive his or her base salary after his termination.

Tax and Accounting Considerations

U.S. federal income tax generally limits the tax deductibility of compensation we pay to our executive officers to $1.0 million in the year the compensation becomes taxable to the executive officers. There is an exception to the limit on deductibility for performance-based compensation that meets certain requirements. Although deductibility of compensation is preferred, tax deductibility is not a primary objective of our compensation programs. Rather, we seek to maintain flexibility in how we compensate our executive officers so as to meet a broader set of corporate and strategic goals and the needs of stockholders, and as such, we may be limited in our ability to deduct amounts of compensation from time to time. Accounting rules require us to expense the cost of our stock option grants. Because of option expensing and the impact of dilution on our stockholders, we pay close attention to, among other factors, the type of equity awards we grant and the number and value of the shares underlying such awards.

Summary Compensation Table

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

NAME & PRINCIPAL POSITION | | YEAR | | SALARY($) | | BONUS($) | | OPTION AWARDS($) (1) | | NON-EQUITY INCENTIVE PLAN COMPENSATION($) | | ALL OTHER COMPENSATION ($) (2) | | TOTAL COMPENSATION ($) |

Steve Hislop | | 2012 | | $ | 392,316 |

| | $ | 1,000 |

| | $ | — |

| | $ | 395,000 |

| | $ | — |

| | $ | 788,316 |

|

President and Chief | | 2011 | | 366,608 |

| | 1,000 |

| | — |

| | 201,200 |

| | — |

| | 568,808 |

|

Executive Officer | | 2010 | | 333,280 |

| | 3,912 |

| | — |

| | 201,750 |

| | — |

| | 538,942 |

|

and Director | | | | | | | | | | | | | | |

Jon Howie | | 2012 | | 250,480 |

| | 1,000 |

| | 258,393 |

| | 250,000 |

| | — |

| | 759,873 |

|

Vice President | | 2011 | | 91,383 |

| | 1,000 |

| | — |

| | 51,451 |

| | — |

| | 143,834 |

|

and Chief Financial Officer | | | | | | | | | | | | | | |

Sharon Russell | | 2012 | | 178,805 |

| | 1,000 |

| | — |

| | 108,000 |

| | — |

| | 287,805 |

|

Secretary and Chief | | 2011 | | 167,094 |

| | 1,000 |

| | — |

| | 55,022 |

| | — |

| | 223,116 |

|

Administrative Officer | | 2010 | | 151,904 |

| | 1,796 |

| | — |

| | 55,173 |

| | — |

| | 208,873 |

|

Frank Biller | | 2012 | | 169,343 |

| | 1,000 |

| | — |

| | 102,000 |

| | — |

| | 272,343 |

|

Vice President | | 2011 | | 162,692 |

| | 1,000 |

| | — |

| | 53,573 |

| | — |

| | 217,265 |

|

of Operations, | | 2010 | | 156,434 |

| | 1,699 |

| | — |

| | 48,428 |

| | — |

| | 206,561 |

|

Southeast Region | | | | | | | | | | | | | | |

Michael Hatcher | | 2012 | | 159,006 |

| | 1,000 |

| | — |

| | 96,000 |

| | — |

| | 256,006 |

|

Vice President | | 2011 | | 149,205 |

| | 1,000 |

| | — |

| | 49,132 |

| | — |

| | 199,337 |

|

of Real Estate | | 2010 | | 135,641 |

| | 1,711 |

| | 79,650 |

| | 49,266 |

| | — |

| | 266,268 |

|

and Development | | | | | | | | | | | | | | |

Ted Zapp | | 2012 | | 178,805 |

| | 1,000 |

| | — |

| | 108,000 |

| | — |

| | 287,805 |

|

Vice President | | 2011 | | 167,094 |

| | 1,000 |

| | — |

| | 55,022 |

| | — |

| | 223,116 |

|

of Operations | | 2010 | | 151,904 |

| | 1,796 |

| | — |

| | 55,173 |

| | — |

| | 208,873 |

|

| |

(1) | Represents the aggregate grant date fair value, calculated in accordance with FASB ASC Topic 718, for awards of options. See note 10 to our consolidated financial statements in our Annual Report on Form 10-K for a discussion of the calculations of grant date fair value. |

| |

(2) | All other aggregate compensation is less than $10,000. |

Grants of Plan-Based Awards

|

| | | | | | | | | | | | | | | | | | | | | |

| | | | ESTIMATED FUTURE PAYOUTS UNDER NON-EQUITY INCENTIVE PLAN AWARDS | | ALL OTHER OPTION AWARDS: NUMBER OF SECURITIES

UNDERLYING

OPTIONS | | EXERCISE OR BASE PRICE OF OPTION

AWARDS

($/SH) | | GRANT DATE FAIR VALUE OF STOCK AND OPTION

AWARDS

($)(1) |

NAME | | GRANT DATE | | THRESHOLD($) | | TARGET($) | | MAXIMUM($) | |

Steve Hislop | | — |

| | — |

| | 197,500 |

| | 395,000 |

| | — |

| | — |

| | — |

|

Jon Howie | | 4/10/2012 |

| | — |

| | 125,000 |

| | 250,000 |

| | 48,938 |

| | 13.54 |

| | 258,393 |

|

Sharon Russell | | — |

| | — |

| | 54,000 |

| | 108,000 |

| | — |

| | — |

| | — |

|

Frank Biller | | — |

| | — |

| | 51,000 |

| | 102,000 |

| | — |

| | — |

| | — |

|

Michael Hatcher | | — |

| | — |

| | 48,000 |

| | 96,000 |

| | — |

| | — |

| | — |

|

Ted Zapp | | — |

| | — |

| | 54,000 |

| | 108,000 |

| | — |

| | — |

| | — |

|

| |

(1) | Represents the aggregate grant date fair value, calculated in accordance with FASB ASC Topic 718, for awards of options. See note 10 to our consolidated financial statements in our Annual Report on Form 10-K for a discussion of the calculations of grant date fair value. |

2012 Omnibus Equity Incentive Plan

Prior to the completion of our IPO, we adopted the 2012 Plan. The purposes of the 2012 Plan are to provide additional incentives to our management, employees, directors, independent contractors and consultants, to strengthen their commitment, motivate them to faithfully and diligently perform their responsibilities and to attract and retain competent and dedicated persons whose contributions are essential to the success of our business and whose efforts will impact our long-term growth and profitability. To accomplish such purposes, the 2012 Plan provides for the issuance of stock options, share appreciation rights, restricted shares, deferred shares, performance shares and other share-based awards, which we refer to as plan awards.

While we intend to issue plan awards to employees, directors, independent contractors or consultants as a recruiting and retention tool, we have not established specific parameters regarding future grants. Our compensation committee will determine the specific criteria surrounding the grant of plan awards. The following description summarizes the expected features of the 2012 Plan.

Summary of 2012 Plan Terms

We reserved a total of 1,250,000 shares of common stock that are available for issuance under the 2012 Plan. When Section 162(m) of the Code becomes applicable to us, the maximum aggregate awards that may be granted during any fiscal year to any individual will be 200,000 shares, and in the case of options to acquire shares, with a per share exercise price equal to the grant date fair market value of a share. If the shares underlying any plan award are forfeited, cancelled, exchanged or surrendered or if a plan award otherwise terminates or expires without a distribution of shares, the shares will again become available under the 2012 Plan provided that shares surrendered or withheld as payment of either the exercise price of an award (including shares otherwise underlying an award of a share appreciation right that are retained by us to account for the grant price of such share appreciation right) and/or withholding taxes in respect of an award will no longer be available for grant under the 2012 Plan, and notwithstanding that a share appreciation right is settled by the delivery of a net number of shares of the full number of shares underlying such share appreciation right will not be available for subsequent awards under the 2012 Plan. In addition, awards are paid or settled in cash, the number of shares with respect to which such payment or settlement is made will again be available for grants of awards under the 2012

Plan and shares underlying awards that can only be settled in cash will not be counted against the aggregate number of shares available for awards under the 2012 Plan.

The 2012 Plan will initially be administered by our board of directors, or any committee or subcommittee the board may appoint to administer the 2012 Plan (such person(s), the plan administrator). The plan administrator may construe and interpret the 2012 Plan and may adopt, alter and repeal rules and make all other determinations necessary or desirable to administer the 2012 Plan.