UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ý

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| |

¨ | Preliminary Proxy Statement |

| |

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

ý | Definitive Proxy Statement |

| |

¨ | Definitive Additional Materials |

| |

¨ | Soliciting Material Pursuant to § 240.14a-12 |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| |

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) | Title of each class of securities to which transaction applies: |

| |

(2) | Aggregate number of securities to which transaction applies: |

| |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

(4) | Proposed maximum aggregate value of transaction: |

| |

¨ | Fee paid previously with preliminary materials. |

| |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) | Amount Previously Paid: |

| |

(2) | Form, Schedule or Registration Statement No.: |

June 13, 2018

Dear Chuy’s Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Chuy’s Holdings, Inc. The meeting will be held on Thursday, August 2, 2018, beginning at 9:00 a.m. at the Embassy Suites Downtown at 300 South Congress Avenue, Austin, Texas 78704.

Information about the meeting and details concerning the matters to be acted upon at the meeting are described in the following notice of Annual Meeting and proxy statement. We hope that you will plan to attend the Annual Meeting.

It is important that your shares be represented. Whether or not you plan to attend the meeting, please vote using the procedures described on the notice of internet availability of proxy materials or on the proxy card or sign, date and promptly return a proxy card in the provided pre-addressed, postage-paid envelope.

We look forward to seeing you at the meeting on August 2nd.

Sincerely,

Steve Hislop

Chairman, President and Chief Executive Officer

CHUY’S HOLDINGS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on August 2, 2018

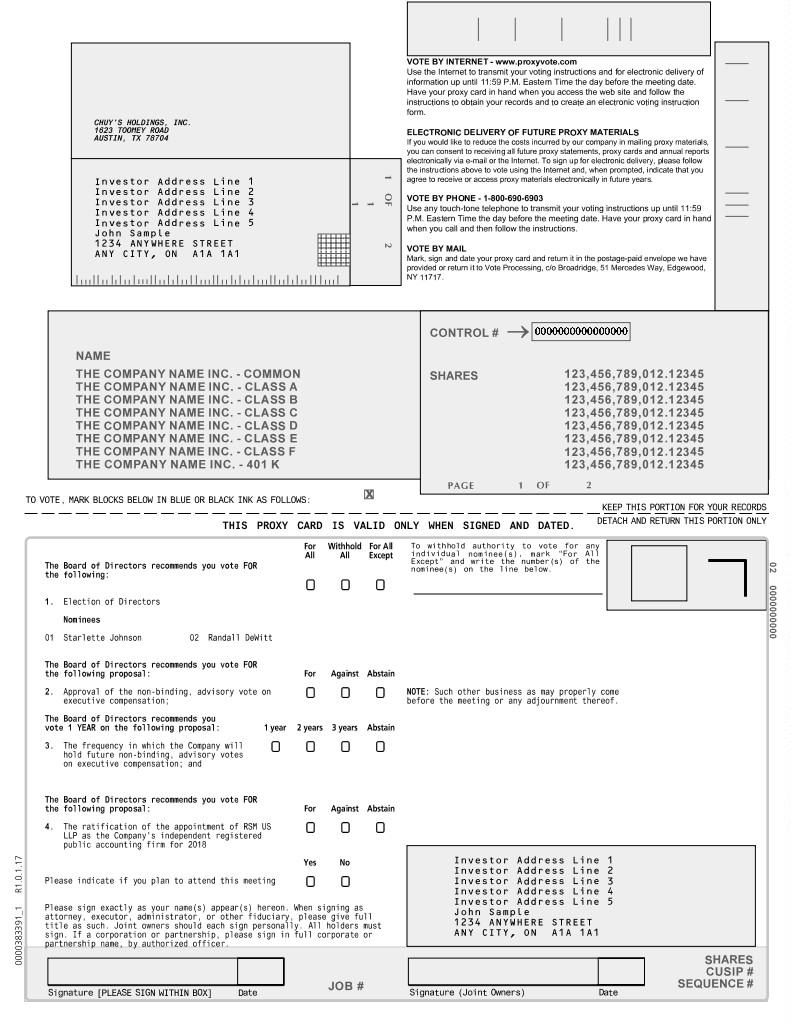

The 2018 Annual Meeting of Stockholders of Chuy’s Holdings, Inc. (the “Company”) will be held on August 2, 2018, beginning at 9:00 a.m. at the Embassy Suites Downtown at 300 South Congress Avenue, Austin, Texas 78704. The meeting will be held for the following purposes:

| |

1. | to elect two directors to serve until the 2021 Annual Meeting of Stockholders, each for a term of three years; |

| |

2. | to approve, on an advisory basis, the compensation of our named executive officers; |

| |

3. | to approve, on an advisory basis, the frequency of future advisory votes on the compensation of our named executive officers; |

| |

4. | to ratify the appointment of RSM US LLP as the Company’s independent registered public accounting firm for 2018; and |

| |

5. | to transact such other business as may properly come before the meeting. |

Information concerning the matters to be voted upon at the meeting is set forth in the accompanying proxy statement. We have also made available the Company’s 2017 Annual Report. Holders of record of the Company’s common stock as of the close of business on June 5, 2018 are entitled to notice of, and to vote at, the meeting.

Your vote is very important. Whether or not you plan to attend the meeting, please vote using the procedures described on the notice of internet availability of proxy materials or on the proxy card or sign, date and promptly return a proxy card in the provided pre-addressed, postage-paid envelope.

If you plan to attend the meeting and will need special assistance or accommodation due to a disability, please describe your needs on the enclosed proxy card.

By Order of the Board of Directors,

Tim Larson

General Counsel and Secretary

Austin, Texas

June 13, 2018

|

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON AUGUST 2, 2018.

The Company’s Notice of Annual Meeting, Proxy Statement and 2017 Annual Report to Stockholders are available on the internet at www.proxyvote.com. |

Table of Contents

Chuy’s Holdings, Inc.

1623 Toomey Road

Austin, Texas 78704

PROXY STATEMENT

This proxy statement provides information in connection with the solicitation of proxies by the board of directors of Chuy’s Holdings, Inc. (the “Company”) for use at the Company’s 2018 Annual Meeting of Stockholders or any postponement or adjournment thereof (the “Annual Meeting”) to be held on Thursday, August 2, 2018, beginning at 9:00 a.m. at the Embassy Suites Downtown at 300 South Congress Avenue, Austin, Texas 78704. This proxy statement also provides information you will need in order to consider and act upon the matters specified in the accompanying notice of Annual Meeting. A Notice of Internet Availability of Proxy Materials (the “Notice”) and this proxy statement and proxy card, are being mailed to stockholders on or about June 15, 2018.

Record holders of the Company’s common stock as of the close of business on June 5, 2018 are entitled to vote at the Annual Meeting. Each record holder of common stock on that date is entitled to one vote at the Annual Meeting for each share of common stock held. As of June 5, 2018, there were 16,946,433 shares of common stock outstanding.

You cannot vote your shares unless you are present at the Annual Meeting or you have previously given your proxy. You can vote by proxy in one of three ways:

| |

• | by internet: visit the website shown on your Notice or proxy card and follow the instructions; or |

| |

• | by telephone: dial the toll-free number shown on your proxy card and follow the instructions; or |

| |

• | in writing: sign, date, and return a proxy card in the provided pre-addressed, postage-paid envelope. |

You may revoke your proxy at any time prior to the vote at the Annual Meeting by:

| |

• | delivering a written notice revoking your proxy to the Company’s Secretary at the address above; |

| |

• | delivering a new proxy bearing a date after the date of the proxy being revoked; or |

| |

• | voting in person at the Annual Meeting. |

Unless revoked as described above, all properly executed proxies, will be voted at the Annual Meeting in accordance with your directions on the proxy. If a properly executed proxy gives no specific instructions, the shares of common stock represented by your proxy will be voted:

| |

• | FOR the election of the two nominees to serve as directors until the 2021 Annual Meeting of Stockholders; |

| |

• | FOR the approval of the compensation of our named executive officers; |

| |

• | FOR the frequency of “1 YEAR” for future advisory votes on the compensation of our named executive officers; |

| |

• | FOR the ratification of the appointment of RSM US LLP as the Company’s independent registered public accounting firm for 2018; and |

| |

• | at the discretion of the proxy holders with regard to any other matter that is properly presented at the Annual Meeting. |

If you own shares of common stock held in “street name” and you do not instruct your broker how to vote your shares using the instructions your broker provides you, your shares will be voted in the ratification of the appointment of RSM US LLP as the Company’s independent registered public accounting firm for 2018, but not for any other proposal. To be sure your shares are voted in the manner you desire, you should instruct your broker how to vote your shares.

Holders of a majority of the outstanding shares of the Company’s common stock must be present, either in person or by proxy, to constitute a quorum necessary to conduct the Annual Meeting. Abstentions and broker non-votes are counted for purposes of determining a quorum and are considered present and entitled to vote.

The following table sets forth the voting requirements, whether broker discretionary voting is allowed and the treatment of abstentions and broker non-votes for each of the matters to be voted on at the Annual Meeting.

|

| | | | | | |

Proposal | | Vote Necessary to Approve Proposal | | Broker Discretionary Voting Allowed? | | Treatment of Abstentions and Broker Non-Votes |

No. 1 - Election of directors | | Plurality (that is, the largest number) of the votes cast | | No | | Abstentions and broker non-votes are not considered votes cast and will have no effect |

No. 2 - Approval of the compensation of our named executive officers, as disclosed in this proxy statement | | Affirmative vote of the majority of the votes of the shares present in person or by proxy at the Annual Meeting and entitled to vote on the matter | | No | | Abstentions will have the effect of a vote cast against the matter and broker non-votes are not considered votes cast |

No. 3 - Advisory vote on the frequency of future votes on the compensation of our named executive officers | | Affirmative vote of the majority of the votes of the shares present in person or by proxy at the Annual Meeting and entitled to vote on the matter | | No | | Abstentions will have the effect of a vote cast against the matter and broker non-votes are not considered votes cast |

No. 4 - Ratification of the appointment of RSM US LLP | | Affirmative vote of a majority of the shares present, in person or by proxy, at the Annual Meeting and entitled to vote on the matter | | Yes | | Abstentions will have the effect of a vote cast against the matter |

Attendance at the Annual Meeting will be limited to stockholders of record and beneficial owners who provide proof of beneficial ownership as of the record date (such as an account statement, a copy of the voting instruction card provided by a broker, bank, trustee, or nominee, or other similar evidence of ownership).

The Company pays the costs of soliciting proxies. We have engaged Georgeson, Inc. to serve as our proxy solicitor for the Annual Meeting at a base fee of $7,500 plus reimbursement of reasonable expenses. Georgeson will provide advice relating to the content of solicitation materials, solicit banks, brokers, institutional investors, and hedge funds to determine voting instructions, monitor voting, and deliver executed proxies to our voting tabulator. Our employees also may solicit proxies by telephone or in person. However, they will not receive additional compensation for soliciting proxies. The Company may request banks, brokers, and other custodians, nominees, and fiduciaries to forward copies of these proxy materials to the beneficial holders and to request instructions for the execution of proxies. The Company may reimburse these persons for their related expenses. Proxies are solicited to provide all record holders of the Company’s common stock an opportunity to vote on the matters to be presented at the Annual Meeting, even if they cannot attend the meeting in person.

PROPOSAL 1 –

ELECTION OF DIRECTORS

At the Annual Meeting, two directors will be elected to serve three-year terms expiring at our Annual Meeting of Stockholders in 2021. This section contains information relating to the two director nominees and the directors whose terms of office continue after the Annual Meeting. The director nominees were selected by the Nominating and Corporate Governance Committee and approved by the board of directors for submission to the stockholders. The nominees for election are Mrs. Johnson and Mr. DeWitt. Both currently serve as directors.

The board of directors recommends a vote “FOR” the election of each of the nominees.

Nominees to be elected for terms expiring at the Annual Meeting in 2021

Starlette Johnson, age 55, has served as a member of our board since September 2012. Since 2012, Starlette has served as an independent consultant to private equity funds, and to companies in the restaurant and hospitality industries. From October 2015 to October 2016, Starlette served as President and Chief Executive Officer of Twin Restaurant Holdings, the parent company of the Twin Peaks restaurant chain. Additionally, she served as President and Chief Operating Officer, as well as a Director, of Dave & Buster’s, Inc. from 2007 to 2010. Starlette joined Dave & Buster’s as Chief Strategic Officer in 2006. Prior to joining Dave & Buster’s, Starlette worked at Brinker International, where she held positions of increasing responsibility, including serving as the Executive Vice President and Chief Strategic Officer. Starlette served as a member of the board of directors for Tuesday Morning, Inc. from 2008 to 2013, during which time she served on the Audit Committee and the Nominating/Governance Committee. Starlette also has served on the board of Bojangle’s (NASDAQ: BOJA) since March 2016, and is chair of the Audit Committee. Since 2015, she has also served as the chairman of the board for SusieCakes, LLC, a privately held bakery. In addition, Starlette is a member of the Advisory Board for the Hospitality & Tourism Program at Virginia Tech and serves on the Pamplin College of Business Cabinet at Virginia Tech. Starlette received a B.S. in Finance from Virginia Tech and an M.B.A. from The Fuqua School of Business at Duke University. The board concluded that Starlette should serve as a director based upon her experience as an executive and board member and her knowledge of the restaurant industry and leadership experience.

Randall DeWitt, age 59, has served as a member of our board since October 2016. Randall is a well-known restaurant executive with over 22 years of restaurant experience. Randall is the founder and has been the chief executive officer of Front Burner Restaurants since 1994. Front Burner currently has ten different concepts and is known for developing innovative restaurant concepts that span the fast casual, casual and upscale casual dining segments. Front Burner operates, among others, Whiskey Cake, Velvet Taco, Sixty Vines, Mexican Sugar, and The Ranch at Las Colinas. Prior to founding Front Burner, Randall worked for ten years in commercial real estate development and sales. The board concluded that Randall should serve as a director based on his operational and business development experience within the restaurant industry.

Current Directors whose terms expire at the Annual Meeting in 2019

Saed Mohseni, age 56, has served as a member of our board since September 2012 and has served as our Lead Independent Director since May 2018. Saed served as the President and Chief Executive Officer and a director of Bob Evans Farms, Inc. from January 2016 until May 2017. In May 2017, he became the Chief Executive Officer of Bob Evans Restaurants LLC. Saed has more than 30 years of management experience in the restaurant industry. Prior to joining Bob Evans Farms, he served as Director, President and Chief Executive Officer of Bravo Brio Restaurant Group, Inc., the parent company of BRAVO! Cucina Italiana, Bon Vie Bistro, and BRIO Tuscan Grille restaurant chains, from 2007 to 2015. He assumed the additional role of President in 2009 and led the company through the IPO process in 2010. Prior to joining Bravo Brio, Saed worked at McCormick & Schmick for 21 years, where he held positions of increasing responsibility, including serving as a Director from 2004 to 2007 and as Chief Executive Officer from 2000 to 2007 and led the company through the IPO process in 2004. Saed attended Portland State University and

Oregon State University. The board concluded that Saed should serve as a director based upon his experience as an executive and board member and his knowledge of the restaurant industry.

Ira Zecher, age 65, has served as a member of our board since June 2011. Ira has been a managing member of ILZ, LLC, an accounting consulting firm since 2010 and has served as a director, audit committee chairman and nominating and corporate governance committee member of the board for The Habit Restaurants, Inc. since August 2014. He previously served as a director, audit committee chairman and compensation committee member of the board of Norcraft Companies, Inc. from October 2013 to May 2015. Prior to joining the Chuy’s board, Mr. Zecher was with Ernst & Young LLP, a registered public accounting firm, for over 36 years until his retirement as a partner in 2010. From 1986 to 2010, he served as a senior transaction advisory services partner and Far East private equity leader for Ernst & Young, where he advised clients on mergers and acquisitions across a broad range of industries. Prior to joining the transaction advisory services group, Ira provided accounting, audit and business-advisory services to both public and private clients. He received his Bachelor's degree from Queens College of the City of New York. He is also a certified public accountant, a member of the American Institute of Certified Public Accountants and the New York State Society of Certified Public Accountants. He also completed the Executive Program of the Kellogg School of Management at Northwestern University. From 2010 to 2013, he taught in the Graduate Accounting program at Rutgers, the State University of New Jersey. The board concluded that Ira should serve as a director based upon his extensive professional accounting and financial expertise, which allow him to provide key contributions to the Board on financial, accounting, corporate governance and strategic matters.

Current Directors whose terms expire at the Annual Meeting in 2020

Steve Hislop, age 58, has served as President, Chief Executive Officer and a member of our board of directors since July 2007 and Chairman of the Board since May 2018. From July 2006 through June 2007, Steve was President and Chief Executive Officer of Sam Seltzer Steak House. Prior to that, Steve served as the Concept President and a member of the board of directors of O’Charley’s Restaurants, where he helped grow the business from 12 restaurants to a multi-concept company with 347 restaurants. Steve currently serves on the board of directors of Not Your Average Joe's, Inc. and Silver Diner, Inc., which are privately held companies. The board concluded that Steve should serve as a director based upon his operational expertise, knowledge of the restaurant industry and leadership experience.

Jon Howie, age 50, has served as our Chief Financial Officer since August 2011, as our Vice President since April of 2013 and as a member of the Board since May 2018. From March 2007 to July 2011, Jon served as the Chief Financial Officer of Del Frisco’s Restaurant Group, LLC. Prior to that, he served for five years as Controller and was then promoted to Chief Accounting Officer of the Lone Star Steakhouse & Saloon, Inc. Jon is a certified public accountant and prior to joining Lone Star Steakhouse & Saloon, Inc. was employed as an audit senior manager with Grant Thornton, LLP for one year and served at Ernst & Young LLP for 10 years where he held various audit positions, including audit senior manager. At Grant Thornton and Ernst & Young, he served as an accounting and business advisor to both private and public companies and advised a number of these companies in conjunction with their initial and secondary public offerings. The board concluded that Jon should serve as a director based upon his knowledge of the restaurant industry and our Company and his financial and leadership experience.

PROPOSAL 2 –

ADVISORY VOTE TO APPROVE THE COMPENSATION OF

OUR NAMED EXECUTIVE OFFICERS

Pursuant to Section 14A of the Securities Exchange Act of 1934 (the “Exchange Act”), we are submitting the compensation of our named executive officers as disclosed in this proxy statement to our stockholders for an advisory vote.

As described below under the heading “Executive Compensation,” we seek to provide compensation to each named executive officer that is designed to attract, motivate and retain our executive officers. Our compensation program is designed to reward both individual and company performance, while aligning the financial interests of each named executive officer with the interests of our stockholders. The compensation committee sets compensation for each named executive officer at a level we believe is appropriate considering each named executive officer’s annual review, level of responsibility, awards and compensation paid in the past year and progress toward or attainment of previously set personal and corporate goals and objectives.

The vote on this proposal is not intended to address any specific element of compensation. Rather, the vote relates to the overall compensation of our named executive officers, as described under the heading “Executive Compensation” in this proxy statement. We are asking our stockholders to approve the following advisory resolution at our Annual Meeting:

“RESOLVED, that the compensation of the Company’s named executive officers, as disclosed pursuant to the rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, compensation tables and narrative discussion is hereby APPROVED.”

The vote is advisory and is not binding on the Company, our board of directors or the compensation committee. However, the compensation committee expects to consider the outcome of this advisory vote in evaluating whether any actions are appropriate with respect to our compensation programs for our executive officers.

The board of directors recommends a vote “FOR” the approval of the compensation of our named executive officers.

PROPOSAL 3 –

ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES

ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

Pursuant to Section 14A of the Exchange Act, we are submitting the frequency of advisory votes on the compensation of our named executive officers to an advisory vote of our stockholders. In voting on this proposal, stockholders may indicate whether they would prefer that we conduct future advisory votes on executive compensation every year, every two years, or every three years. Stockholders also may, if they wish, abstain from voting on this proposal.

Our board of directors has determined that an advisory vote each year on executive compensation is the most appropriate approach for the Company and its stockholders. In making its recommendation, our board of directors considered that an annual advisory vote on executive compensation allows our stockholders to provide us with timely and direct input on our compensation policies, programs and practices.

Our board of directors recommends that you vote for an annual advisory vote on executive compensation. This vote is advisory and not binding on the Company or our board of directors. However, our board of directors intends to evaluate the voting results on this proposal in determining how frequently the Company will submit advisory votes on executive compensation to our stockholders.

The proxy card provides stockholders with the opportunity to choose among four options (holding the vote every one, two or three years, or abstaining). Stockholders are not voting to approve or disapprove the recommendation of the board of directors.

The board of directors unanimously recommends that you vote for a frequency of “1 YEAR.”

PROPOSAL 4 -

RATIFICATION OF APPOINTMENT OF

RSM US LLP AS THE COMPANY’S INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM FOR 2018

The audit committee has appointed RSM US LLP as the Company’s independent registered public accounting firm for 2018. The board of directors is asking stockholders to ratify this appointment. Securities and Exchange Commission (“SEC”) regulations and the Nasdaq listing requirements require the Company’s independent registered public accounting firm to be engaged, retained and supervised by the audit committee. However, the board of directors considers the selection of an independent registered public accounting firm to be an important matter to stockholders. Accordingly, the board of directors considers a proposal for stockholders to ratify this appointment to be an opportunity for stockholders to provide input to the audit committee and the board of directors on a key corporate governance issue.

Representatives of RSM US LLP are expected to be present at the Annual Meeting and will have the opportunity to make a statement. They will also be available to respond to appropriate questions. For additional information regarding our independent registered public accounting firm, see “Independent Public Accountants.”

The board of directors recommends a vote “FOR” the ratification of RSM US LLP as the Company’s independent registered public accounting firm for 2018.

The Board, Its Committees and Its Compensation

Board of Directors

The board of directors presently consists of six members, four of whom are non-employee directors. The board of directors is divided into three classes, with each class serving three-year terms. The term of one class expires at each Annual Meeting of Stockholders.

Director Compensation

The elements of compensation payable to our non-employee directors in 2017 are briefly described in the following table:

|

| | | |

Board Service: | |

Annual cash retainer | $ | 40,000 |

|

Annual equity award grant | $ | 40,000 |

|

Board Committee Service: | |

Audit Committee Chair annual cash retainer | $ | 10,000 |

|

Compensation Committee Chair annual cash retainer | $ | 5,000 |

|

Nominating & Corporate Governance Committee Chair annual cash retainer | $ | 2,500 |

|

Our non-employee directors receive compensation for their services as directors. Committee chairs receive additional compensation for serving as chairs. In connection with the appointment of a Lead Independent Director in May 2018, the board determined to pay the Lead Independent Director an additional annual cash retainer equal to $5,000. Other than described above, the board has not made any additional changes to non-employee director compensation for 2018. We reimburse directors for all expenses incurred in attending board meetings.

Grants of equity awards to members of our board of directors are made under the 2012 Plan. These equity awards vest 25% on each of the first four anniversaries of the grant date subject to the director’s continued service on the board.

Director Compensation Table

The following table provides information regarding the compensation of our non-management directors for the year ended December 31, 2017:

|

| | | | | | | | | |

NAME | | FEES EARNED OR PAID IN CASH ($) | | STOCK AWARDS ($) | | TOTAL |

Mike Young | | 20,000 |

| (1) | 39,988 |

| (2) | 59,988 |

|

John Zapp (3) | | 40,000 |

| | 39,988 |

| (2) | 79,988 |

|

Starlette Johnson | | 42,500 |

| | 39,988 |

| (2) | 82,488 |

|

Saed Mohseni | | 45,000 |

| | 39,988 |

| (2) | 84,988 |

|

Ira Zecher | | 50,000 |

| | 39,988 |

| (2) | 89,988 |

|

Randall DeWitt | | 40,000 |

| | 39,988 |

| (2) | 79,988 |

|

| |

(1) | Mike Young resigned from the board of directors on April 27, 2017. The fees paid are for a partial year of service. |

| |

(2) | These restricted stock units were granted on March 15, 2017 and vest 25% on each of the first four anniversaries of the grant date. |

| |

(3) | John Zapp resigned from the board of directors on May 9, 2018. |

The grant date fair value of each award was equal to the closing price of the Company's stock on the date of grant as calculated in accordance with FASB ASC Topic 718 (“Topic 718”). Pursuant to SEC rules, the amounts shown in this column exclude the impact of estimated forfeitures related to service-based vesting conditions. See Note 11 to our consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2017 for information regarding the assumptions made in determining these values.

The following table provides information regarding the aggregate number of option and restricted stock unit awards held by our non-employee directors as of December 31, 2017:

|

| | | | | | | | | | | |

NAME | | AGGREGATE OPTION AWARDS | | AGGREGATE RESTRICTED STOCK UNIT AWARDS | | TOTAL AGGREGATE NUMBER OF AWARDS | |

John Zapp | | — |

| | 3,361 |

| | 3,361 |

| (1 | ) |

Starlette Johnson | | 7,250 |

| | 3,361 |

| | 10,611 |

| |

Saed Mohseni | | 7,250 |

| | 3,361 |

| | 10,611 |

| |

Ira Zecher | | 4,350 |

| | 3,361 |

| | 7,711 |

| |

Randall DeWitt | | — |

| | 1,653 |

| | 1,653 |

| |

(1) These restricted stock units were forfeited as a result of Mr. Zapp’s resignation on May 9, 2018.

Director Independence

Our board of directors will review at least annually the independence of each director. During these reviews, the board will consider transactions and relationships between each director (and his or her immediate family and affiliates) and our Company and its management to determine whether any such transactions or relationships are inconsistent with a determination that the director is independent. This review will be based primarily on responses of the directors to questions in a directors’ and officers’ questionnaire regarding employment, business, familial, compensation and other relationships with the Company and our management. Our board of directors has determined that each of Ira Zecher, Starlette Johnson, Saed Mohseni and Randall DeWitt are independent within the meaning of the Nasdaq Marketplace Rules. As required by the Nasdaq Global Select Market, a majority of our directors are independent and our independent directors meet in regularly scheduled executive sessions at which only independent directors are present.

Corporate Governance

We believe that good corporate governance is important to ensure that, as a public company, we will be managed for the long-term benefit of our stockholders. We and our board of directors have been reviewing the corporate governance policies and practices of other public companies, as well as those suggested by various authorities in corporate governance. We have also considered the provisions of the Sarbanes-Oxley Act and the rules of the SEC and the Nasdaq Global Select Market.

Based on this review, we have established and adopted charters for the audit committee, compensation committee and nominating and corporate governance committee, corporate governance guidelines as well as a code of business conduct and ethics applicable to all of our directors, officers and employees.

Our committee charters, code of business conduct and ethics and corporate governance guidelines are available on our website at www.chuys.com in the Investors section. Copies of these documents are also available upon written request to our Corporate Secretary. We will post information regarding any amendment to, or waiver from, our code of business conduct and ethics on our website in the Investors section.

The board of directors periodically reviews its corporate governance policies and practices. Based on these reviews, the board of directors may adopt changes to policies and practices that are in our best interests and as appropriate to comply with any new SEC or Nasdaq Marketplace Rules.

Board Leadership Structure and Board’s Role in Risk Oversight

On May 9, 2018, our President and Chief Executive Officer, Steve Hislop, was appointed by the board of directors as Chairman of the board. Mr. Hislop replaced John Zapp as Chairman of the board. Mr. Zapp resigned from the board on May 9, 2018. Mr. Hislop has served as our President and Chief Executive Officer and a member of the board since July 2007. We believe that the Company and its shareholders are best served by having Mr. Hislop serve in both positions because of his knowledge of the Company’s operations, our unique culture and industry, in which we are competing. This leadership structure will strengthen the communication link between the operating organization and the board. It will also foster a collaborative environment that supports effective decision-making around key topics such as strategic objectives, long-term planning and enterprise risk management.

In connection with the board’s decision to appoint Mr. Hislop as Chairman of the board in addition to his roles as President and Chief Executive Officer of the Company, the board determined it was appropriate to appoint a Lead Independent Director, who would be elected annually. Mr. Mohseni was elected to serve as our Lead Independent Director.

The role of our Lead Independent Director is to, among other things, preside at executive sessions of independent directors, serve as a liaison between the independent directors and the Chairman, approve board meeting agendas and the information sent to the board, approve meeting schedules to assure that there is sufficient time for discussion of all agenda items, call meetings of independent directors and, if requested by major shareholders, ensure that he or she is available for consultation and direct communication. For further information on our board leadership, including the role of our Lead Independent Director see our corporate governance guidelines, which can be found on our website ( www.chuys.com).

Risk is inherent with every business and we face a number of risks as outlined in Item 1A. “Risk Factors” included in the Company's Annual Report on Form 10-K. Management is responsible for the day-to-day management of risks we face, while our board of directors, as a whole and through our audit committee, is responsible for overseeing our management and operations, including overseeing its risk assessment and risk management functions. Our board of directors has delegated responsibility for reviewing our policies with respect to risk assessment and risk management to our audit committee through its charter. Our board of directors has determined that this oversight responsibility can be most efficiently performed by our audit committee as part of its overall responsibility for providing independent, objective oversight with respect to our accounting and financial reporting functions, internal and external audit functions and systems of internal controls over financial reporting and legal, ethical and regulatory compliance. Our audit committee will regularly report to our board of directors with respect to its oversight of these areas.

Board Meetings

The board of directors held six meetings during 2017. Each director serving on the board of directors in 2017 attended at least 75% of the total number of meetings of the board of directors and committees on which they served. Under our corporate governance guidelines, each director is expected to devote the time necessary to appropriately discharge his responsibilities and to rigorously prepare for, attend and participate in all board of directors meetings and meetings of committees on which he serves.

Annual Meetings of Stockholders

The Company’s directors are encouraged to attend our Annual Meeting of stockholders, but we do not currently have a policy relating to directors’ attendance at these meetings. Each director serving on the board of directors in 2017 attended our 2017 Annual Meeting of Stockholders.

Board Committees

Our board of directors has three standing committees: an audit committee, a compensation committee and a nominating and corporate governance committee. The composition and responsibilities of each committee are described below. Members will serve on these committees until their resignation or until otherwise determined by our board of directors.

Audit Committee

Our audit committee is a standing committee of our board of directors. The audit committee met five times in 2017. According to our audit committee charter, the functions of our audit committee include, but are not limited to:

| |

• | appointing, retaining and determining the compensation for our independent registered public accounting firm; |

| |

• | reviewing and overseeing our independent registered public accounting firm; |

| |

• | reviewing and discussing the effectiveness of internal control over financial reporting; |

| |

• | reviewing and discussing the annual audited and quarterly unaudited financial statements and the selection, application and disclosures of critical accounting policies used in such financial statements; and |

| |

• | establishing procedures for the receipt, retention and treatment of complaints regarding internal accounting controls. |

Our audit committee currently consists of Ira Zecher, Starlette Johnson and Saed Mohseni, with Ira Zecher serving as chairman. All of our audit committee members are independent as defined by Section 10A(m)(3) of the Exchange Act and the Nasdaq Marketplace Rules. Our audit committee charter also requires us to have at least one audit committee financial expert. Our board of directors has determined that Ira Zecher is an audit committee financial expert.

Our board of directors has adopted a written charter under which the audit committee operates. A copy of the charter, which satisfies the applicable standards of the SEC and the Nasdaq Global Select Market, is available on our website. The audit committee has the authority to engage independent counsel and other advisors as the committee deems necessary to carry out its duties.

Compensation Committee

Our compensation committee is a standing committee of our board of directors. The compensation committee met four times in 2017. The compensation committee’s functions include:

| |

• | reviewing and recommending to our board of directors the salaries and benefits for our executive officers; |

| |

• | recommending overall employee compensation policies; and |

| |

• | administering our equity compensation plans. |

Our compensation committee currently consists of Saed Mohseni, Ira Zecher and Randall DeWitt, with Saed Mohseni serving as chairman. All members of our compensation committee are independent as defined by Section 10(c) of the Exchange Act, Rule 10C of the Exchange Act Rules and the Nasdaq Marketplace Rules.

Our board of directors has adopted a written charter under which the compensation committee operates. A copy of the charter, which satisfies the applicable standards of the SEC and the Nasdaq Global Select Market, is available on our website. The compensation committee has the sole authority to retain and terminate compensation consultants to assist in the evaluation of director or executive officer compensation and the sole authority to approve the fees and other retention terms of such compensation consultants. The compensation committee may also retain independent counsel and other independent advisors to assist it in carrying out its responsibilities. The compensation committee may also, in its discretion, delegate specific duties and responsibilities to a subcommittee or an individual committee member, to the extent permitted by applicable law.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee is a standing committee of our board of directors. The nominating and corporate governance committee met four times in 2017. The functions of our nominating and corporate governance committee include:

| |

• | identifying individuals qualified to serve as members of our board of directors; |

| |

• | recommending to our board nominees for our annual meetings of stockholders; |

| |

• | evaluating our board’s performance; |

| |

• | developing and recommending to our board corporate governance guidelines; and |

| |

• | providing oversight with respect to corporate governance and ethical conduct. |

Our nominating and corporate governance committee consists of Starlette Johnson and Saed Mohseni, with Starlette Johnson serving as the committee chairman. All members of our nominating and corporate governance committee are independent as defined by the Nasdaq Marketplace rules.

Our board of directors has adopted a written charter under which the nominating and corporate governance committee operates. A copy of the charter, which satisfies the applicable standards of the SEC and the Nasdaq Global Select Market, is available on our website. The nominating and corporate governance committee has the sole authority to retain and terminate any search firm to assist in the identification of director candidates and the sole authority to set the fees and other retention terms of such search firms. The committee may also retain independent counsel and other independent advisors to assist it in carrying out its responsibilities.

Other Committees

Our board of directors may establish other committees as it deems necessary or appropriate from time to time.

Compensation Committee Interlocks and Insider Participation

None of our executive officers have served as a member of the board of directors or compensation committee of any related entity that has one or more executive officers serving on our board of directors or compensation committee.

Code of Business Conduct and Ethics

We have adopted a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer, and persons performing similar functions (“covered persons”). A current copy of the code is posted on our website, which is located at www.chuys.com. Any amendments to or waivers from a provision of our code of conduct and ethics that applies to our covered persons and that relates to the elements of Item 406(b) of Regulation S-K will be disclosed on our website promptly following the date of such amendment or waiver.

Qualifications for Director Nominees

The nominating and corporate governance committee is responsible for reviewing with the board of directors, at least annually, the appropriate skills and experience required for members of the board of directors. This assessment includes factors such as judgment, skill, diversity, integrity, experience with businesses and other organizations of comparable size, the interplay of the candidate’s experience with the experience of other board members, and the extent to which the candidate would be a desirable addition to the board of directors and any committees of the board of directors.

Director Candidate Recommendations by Stockholders

The committee will review and evaluate any director nominations submitted by stockholders, including reviewing the qualifications of, and making recommendations to the board of directors regarding, director nominations submitted by stockholders. See “Communications with the Board of Directors” below for additional information on how to submit a director nomination to the board of directors.

Communications with the Board of Directors

Any stockholder or other interested party who wishes to communicate directly with the board of directors or any of its members may do so by writing to: Corporate Secretary, Chuy’s Holdings, Inc., 1623 Toomey Road, Austin, TX, 78704. The mailing envelope should clearly indicate whether the communication is intended for the board of directors as a group, the non-employee directors or a specific director.

Executive Officers

The following sets forth information regarding the executive officers of the Company as of June 5, 2018:

|

| | | | |

NAME | | AGE | | POSITIONS |

Steve Hislop | | 58 | | President and Chief Executive Officer |

Jon Howie | | 50 | | Vice President and Chief Financial Officer |

Michael Hatcher | | 57 | | Vice President of Real Estate and Development |

Information regarding Messrs. Hislop and Howie is included above under “Election of Directors.”

Michael Hatcher has served as our Vice President of Real Estate and Development since November 2009. Michael joined Chuy’s as a restaurant manager in 1987 and served as General Manager from 1989 to 2002. He was Director of Purchasing and Real Estate from 2002 to 2009.

Executive Compensation

Compensation Discussion and Analysis

This compensation discussion provides an overview of our executive compensation program, together with a description of the material factors underlying the decisions that resulted in the compensation provided to our Chief Executive Officer and Chief Financial Officer and our two other highest paid executive officers during fiscal year 2017 (collectively, the “named executive officers”). During fiscal year 2017, there were only four executive officers of the Company. Subsequent to the end of fiscal year 2017, Sharon Russell resigned from her positions as Chief Administrative Officer and Secretary of the Company effective March 6, 2018. This compensation discussion contains statements regarding our performance targets and goals. These targets and goals are disclosed in the limited context of our compensation program and should not be understood to be statements of management’s expectations or estimates of financial results or other guidance. We specifically caution investors not to apply these statements to other contexts.

Objective of Compensation Policy

The objective of our compensation policy is to provide a total compensation package to each named executive officer that will enable us to:

| |

• | attract, motivate and retain outstanding individuals; |

| |

• | reward named executive officers for performance; and |

| |

• | align the financial interests of each named executive officer with the interests of our stockholders to encourage each named executive officer to contribute to our long-term performance and success. |

Overall, our compensation program is designed to reward both individual and company performance. A significant portion of each of our named executive officers’ annual compensation is comprised of performance-based bonuses. We also intend to continue to use long-term incentive awards to reward long-term company and individual performance and to promote retention through delayed vesting of awards.

Administration

Our compensation committee, which is comprised exclusively of independent directors, oversees our executive compensation program and is responsible for approving or recommending to the board the nature and amount of the compensation paid to, and any employment and related agreements entered into with, our named executive officers. The committee also administers our equity compensation plans and awards.

Process for Setting Total Compensation

At the first meeting of each new fiscal year, our compensation committee sets annual base salaries, determines the amount of performance-based and discretionary bonuses for the prior year, sets performance criteria for our performance-based bonuses for the following year and determines the amount of equity based incentive compensation to grant to our named executive officers. In making these compensation decisions, our compensation committee considers the recommendations of our Chief Executive Officer, particularly with respect to salary adjustments, performance-based and discretionary bonus targets and awards and equity incentive awards of our other named executive officers. Our compensation committee meets with our Chief Executive Officer at least annually to discuss and review his recommendations for compensation of our executive officers, excluding himself. When making individual compensation decisions for our named executive officers, the compensation committee takes many factors into account, including the officer’s experience, responsibilities, management abilities and job performance, our performance as a whole, current market conditions and competitive pay levels for similar positions at comparable companies. These factors are considered by the compensation committee in a subjective manner without any specific formula or weighting.

During its annual review process, our compensation committee has set compensation for each named executive officer at a level we believe is appropriate considering each named executive officer’s annual review, level of responsibility, the awards and compensation paid to the named executive officer in past years and progress toward or attainment of previously set personal and corporate goals and objectives, including attainment of financial performance goals and such other factors as the compensation committee has deemed appropriate and in our best interests and the best interests of our stockholders. The compensation committee has given different weight at different times to different factors for each named executive officer. Our performance criteria are discussed more fully below under the heading “—Bonus Compensation—Performance-Based Bonus.” Other than with respect to our performance-based bonuses, the compensation committee has not relied on predetermined formulas or a limited set of criteria when it evaluates the performance of our named executive officers.

The charter of the compensation committee authorizes the committee to engage independent consultants at the expense of the Company.

Elements of Compensation

Our compensation program for named executive officers consists of the following elements of compensation, each described in greater depth below:

| |

• | Performance-based and discretionary bonuses. |

| |

• | Equity-based incentive compensation. |

| |

• | Severance and change-in-control benefits. |

We may, from time to time, enter into written agreements to reflect the terms and conditions of employment of a particular named executive officer, whether at the time of hire or thereafter. We consider entering into these agreements when it serves as a meaningful recruitment and retention mechanism. We currently have employment agreements in place with each of our named executive officers. See “Employment Agreements” for additional information regarding our executive officer’s employment agreements.

Base Salary

|

| | |

NAME | 2017 SALARY ($) |

Steve Hislop | 630,823 |

|

Jon Howie | 314,962 |

|

Michael Hatcher | 208,000 |

|

Sharon Russell | 109,499 |

|

We pay base salaries to attract, recruit and retain qualified employees. Our compensation committee reviews and sets base salaries of our named executive officers annually. These salary levels are and will continue to be set based on the named executive officer’s experience and performance with previous employers and negotiations with individual named executive officers. The compensation committee may increase base salaries each year based on its subjective assessment of our company’s and the individual executive officer’s performance and each named executive officer’s experience, length of service and changes in responsibilities. The weight given to such factors by the compensation committee may vary from one named executive officer to another.

Bonus Compensation

|

| | | | | | | | | | | | | |

| PERFORMANCE-BASED BONUS |

NAME | DISCRETIONARY AWARD ($) | | THRESHOLD AWARD ($) | | TARGET AWARD ($) | | MAXIMUM AWARD ($) | | ACTUAL AWARD ($) |

Steve Hislop | 1,000 |

| | — |

| | 315,412 |

| | 630,823 |

| | — |

Jon Howie | 1,000 |

| | — |

| | 157,481 |

| | 314,962 |

| | — |

Michael Hatcher | 1,000 |

| | — |

| | 62,400 |

| | 124,800 |

| | — |

Sharon Russell | 1,000 |

| | — |

| | 32,850 |

| | 65,700 |

| | — |

Performance-Based Bonus

In line with our strategy of rewarding performance, our executive compensation program includes performance-based bonuses to named executive officers under our cash bonus plan. Our compensation committee establishes annual target performance-based bonuses for each named executive officer during the first quarter of the year.

The target and maximum performance-based bonuses have been set at levels our compensation committee believes will provide a meaningful incentive to achieve company and individual goals and contribute to our financial performance. In 2017, the target and maximum performance-based bonus were set at 50% and 100%, respectively, of annual base salary for our Chief Executive Officer and Chief Financial Officer and 30% and 60%, respectively, of annual base salary for our other named executive officers. No bonus is paid if actual Company Adjusted EBITDA is 90% or less of budget Company Adjusted EBITDA. To the extent that actual Company Adjusted EBITDA exceeds 90% of budget Company Adjusted EBITDA, the plan provides that we will pay a bonus based on where performance falls on a linear basis between 90% and 100% of budget Company Adjusted EBITDA and between 100% and 110% of budget Company Adjusted EBITDA. In each circumstance, the compensation committee retains discretion to adjust the amount paid under the plan based on individual and company circumstances. If our budgeted Company Adjusted EBITDA is achieved, each individual will earn 100% of their target bonus.

This performance bonus is determined based primarily on the extent to which we achieve our budget Company Adjusted EBITDA goal. Company Adjusted EBITDA is our earnings before interest, taxes, depreciation and amortization plus any loss on sales of asset (less any gain on a sale of assets) and excludes stock-based compensation and certain non-cash and other adjustments. For each 1.0% that actual Company Adjusted EBITDA is above or below budget Company Adjusted EBITDA, the percentage of the target they receive will increase or decrease by 10%, respectively, of the Company Adjusted EBITDA portion of their target bonus. For example, if actual Company Adjusted EBITDA is 1% above budget Company Adjusted EBITDA, the named executive officers will receive 1.1 times their target bonus. The maximum a named executive officer may receive for Company Adjusted EBITDA performance is 2.0 times their target bonus. We use our Company Adjusted EBITDA, together with financial measures prepared in accordance with GAAP,

such as revenue, net income and cash flows from operations, to assess our historical and prospective operating performance and to enhance our understanding of our core operating performance. We also use our Company Adjusted EBITDA internally to evaluate the performance of our personnel and also as a benchmark to evaluate our operating performance or compare our performance to that of our competitors. The use of Company Adjusted EBITDA as a performance measure permits a comparative assessment of our operating performance relative to our performance based on our GAAP results, while isolating the effects of some items that vary from period to period without any correlation to core operating performance or that vary widely among similar companies.

Target, maximum and actual performance-based bonuses for 2017 for each of the named executive officers are shown in the table above and the actual paid performance-based bonus is shown in the “Non-Equity Incentive Plan Compensation” column of the Summary Compensation Table. For fiscal year 2017, no performance-based bonuses were paid because our actual Company Adjusted EBITDA was less than 90% of our budget Company Adjusted EBITDA.

Discretionary Bonus

Historically, each of our named executive officers has received a $1,000 holiday bonus each December. The discretionary bonuses awarded to our named executive officers in 2017 are set forth in the “Bonus” column of the Summary Compensation Table.

Equity Compensation

We pay equity-based compensation to our named executive officers because it links our long-term results achieved for our stockholders and the rewards provided to named executive officers, thereby ensuring that such officers have a continuing stake in our long-term success.

Historically, we have granted equity awards to our named executive officers in conjunction with significant transactions and in connection with a named executive officer’s initial hire or promotion. Additionally, we have granted equity awards to our named executive officers annually to further align the interests of our executives with those of our stockholders. For information regarding the number and grant date fair value of deferred shares (referred to herein as restricted stock units) granted to our named executive officers during fiscal year 2017, see "—Grants of Plan Based Awards” below.

We have provided this equity compensation to reward performance as well as to promote retention through delayed vesting. However, we believe that by weighting total compensation in favor of performance-based and discretionary bonuses, we have appropriately rewarded individual achievement while at the same time providing incentives to promote Company performance. In addition to stock options and restricted stock units, the 2012 Omnibus Equity Incentive Plan (the "2012 Plan") provides for the issuance of share appreciation rights, restricted shares, performance shares and other share based awards. In the future, we may consider granting other forms of equity to our named executive officers. For additional information regarding our 2012 Plan, see below under the heading "—2012 Omnibus Equity Incentive Plan.”

We will make future grants of equity awards to the current named executive officers and other employees under the 2012 Plan. The compensation committee may grant stock options, restricted stock units or a combination of both.

We also make grants of equity awards to our named executive officers and other employees because we believe that we should provide our employees an opportunity to share in our success provided they continue to contribute to our success.

Restricted stock units held by each of the named executive officers (and certain of our other salaried employees) vest ratably over a period of four years, subject to the applicable named executive officer remaining employed through each vesting date.

Severance and Change-in-Control Benefits

We currently have employment agreements with each of our named executive officers that provide termination or severance benefits. We agreed to pay termination or severance benefits in the event of an executive’s termination by us without cause as a retention incentive. We believe this level of severance benefit provides our executives with the assurance of security if their employment is terminated for reasons beyond their control. For additional information

on the severance benefits provided under the employment agreements with our executive officers see “—Employment Agreements.”

Under the 2012 Plan, a named executive officer's awards granted under that plan will immediately vest in the event a change in control (as defined in the 2012 Plan) occurs and the officer's employment is terminated without cause within 24 months following the change in control.

The amount each named executive would be entitled to receive in the event of a termination is reported below under the heading “—Potential Payments upon Termination or Change in Control.”

Perquisites

In 2017, the aggregate incremental cost to us of the perquisites received by each of the named executive officers did not exceed $10,000 and, accordingly, this benefit is not included in the Summary Compensation Table below. We provide the named executive officers with complimentary dining privileges at our restaurants. We view complimentary dining privileges as a meaningful benefit to our named executive officers as it is important for named executive officers to experience our products and services in order to better perform their duties for us.

General Benefits

We provide a limited number of personal benefits to our named executive officers. Our named executive officers participate in our health and benefit plans, and are entitled to vacation and paid time off based on our general vacation policies.

The following are standard benefits offered to all of our eligible employees, including the named executive officers.

Retirement Benefits. We maintain a tax-qualified 401(k) savings plan. Employees are eligible after one year of service and may defer up to the maximum amount allowable by the IRS.

Medical, Dental, Life Insurance and Disability Coverage. Active employee benefits such as medical, dental, life insurance and disability coverage are available to all eligible employees, including our named executive officers.

Moving Costs. We will reimburse out-of-pocket moving expenses for eligible executive officers in conjunction with their hiring.

Other Paid Time Off Benefits. We also provide vacation and other paid holidays to all employees, including the named executive officers, which we believe are appropriate for a company of our size and in our industry.

Employment Agreements

We have entered into employment agreements with Messrs. Hislop, Howie and Hatcher and Mrs. Russell. The employment agreements do not provide for fixed terms.

The employment agreements provide that Messrs. Hislop, Howie and Hatcher and Mrs. Russell, will receive an annual base salary of at least $366,608, $250,000, $149,205 and $167,094, respectively. In 2017, the Company and Mrs. Russell agreed to reduce her salary to $109,499. Mr. Hislop and Mr. Howie are each eligible to receive a target annual bonus of 50% of their annual base salary, based upon the achievement of goals and objectives determined by our compensation committee with a minimum and maximum bonus of 0% and 100% of their annual base salary, respectively. Mr. Hatcher and Mrs. Russell are eligible to receive a target annual bonus of 30% of their annual base salary, based upon the achievement of goals and objectives determined by our compensation committee with a minimum and maximum bonus of 0% and 60% of their annual base salary respectively. The employment agreements provide that each executive will be eligible to participate in employee plans, including 401(k), medical and dental plans, made available to our other senior executives generally.

Each employment agreement provides for severance benefits if the executive’s employment is terminated without cause (as defined in the employment agreement), subject to the executive’s compliance with certain confidentiality, non-compete, non-solicitation and non-disparagement obligations and the execution of a general release of claims. In the event Mr. Hislop’s employment is terminated without cause, he is entitled to continue to receive his base salary for two years following the termination of his employment. In the event Mr. Howie, Mr. Hatcher or Mrs. Russell is terminated without cause, each is entitled to continue to receive one year’s base salary following their termination. In the event of termination, all of our executive officers are entitled to continue to receive the amount that the Company

was subsidizing for the executive and his or her dependents’ medical and dental insurance coverage during the same period the executive is entitled to continue to receive his or her base salary after his termination.

Tax and Accounting Considerations

Section 162(m) of the Internal Revenue Code (the "Code") generally limits the tax deductibility of compensation we pay to our executive officers to $1.0 million in the year the compensation becomes taxable to the executive officers. Historically, there was an exception to the limit on deductibility for "performance-based compensation" that meets certain requirements under Section 162(m) of the Code, but this exception has now been repealed, effective for taxable years beginning after December 31, 2017, unless transition relief for certain compensation arrangements in place as of November 2, 2017 is available. In addition, effective for taxable years beginning after December 31, 2017, the group of executive officers whose compensation is subject to Section 162(m) limitation on deductibility was expanded to include the chief financial officer. As a result, compensation paid to our executive officers in excess of $1.0 million may not be deductible unless it is "performance-based compensation" that qualifies for certain transition relief. Although deductibility of compensation is preferred, tax deductibility is not a primary objective of our compensation programs. Rather, we seek to maintain flexibility in how we compensate our executive officers so as to meet a broader set of corporate and strategic goals and the needs of stockholders, and as such, we may be limited in our ability to deduct the full amount of such compensation.

Accounting rules require us to expense the cost of our stock option and restricted stock unit awards. Because of option and restricted stock unit expensing and the impact of dilution on our stockholders, we pay close attention to, among other factors, the type of equity awards we grant and the number and value of the shares underlying such awards.

Summary Compensation Table

|

| | | | | | | | | | | | | |

NAME & PRINCIPAL POSITION | YEAR | SALARY ($) | BONUS ($) | STOCK

AWARDS

($)(1) | OPTION AWARDS ($)(1) | NON-EQUITY INCENTIVE PLAN COMPENSATION ($) | ALL OTHER COMPENSATION ($)(2) | TOTAL COMPENSATION ($) |

Steve Hislop President and Chief Executive Officer | 2017 | 630,823 |

| 1,000 |

| 630,807 |

| — | — |

| — | 1,262,630 |

|

2016 | 606,561 |

| 1,000 |

| 454,920 |

| — | 365,648 |

| — | 1,428,129 |

|

2015 | 583,232 |

| 1,000 |

| 291,613 |

| — | 583,232 |

| — | 1,459,077 |

|

Jon Howie Vice President and Chief Financial Officer | 2017 | 314,962 |

| 1,000 |

| 236,220 |

| — | — |

| — | 552,182 |

|

2016 | 302,848 |

| 1,000 |

| 227,132 |

| — | 182,564 |

| — | 713,544 |

|

2015 | 291,200 |

| 1,000 |

| 291,196 |

| — | 291,200 |

| — | 874,596 |

|

Michael Hatcher Vice President of Real Estate and Development | 2017 | 208,000 |

| 1,000 |

| 103,974 |

| — | — |

| — | 312,974 |

|

2016 | 200,000 |

| 1,000 |

| 99,988 |

| — | 72,339 |

| — | 373,327 |

|

2015 | 179,978 |

| 1,000 |

| 89,983 |

| — | 107,986 |

| — | 378,947 |

|

Sharon Russell

Former Secretary and Chief Administrative Officer (3) | 2017 | 109,499 |

| 1,000 |

| 82,098 |

| — | — |

| — | 192,597 |

|

2016 | 210,575 |

| 1,000 |

| 157,928 |

| — | 76,163 |

| — | 445,666 |

|

2015 | 202,476 |

| 1,000 |

| 101,219 |

| — | 121,486 |

| — | 426,181 |

|

| |

(1) | Represents the aggregate grant date fair value, calculated in accordance with the Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") Topic 718, for awards of options and restricted stock units. See Note 11 to our consolidated financial statements for a discussion of the calculations of grant date fair value. |

| |

(2) | All other compensation is less than $10,000. |

| |

(3) | On March 6, 2018, Mrs. Russell resigned from her positions as Chief Administrative Officer and Secretary of the Company and notified the Company of her intent to retire from the Company effective August 5, 2018. |

Grants of Plan-Based Awards

|

| | | | | | | | | | | | | | | | | | | |

NAME | | COMMITTEE ACTION DATE | | GRANT DATE | | ESTIMATED FUTURE PAYOUTS UNDER NON-EQUITY INCENTIVE PLAN AWARDS | | ALL OTHER STOCK AWARDS: NUMBER OF SHARES OF STOCK OR UNITS (#) | | GRANT DATE FAIR VALUE OF STOCK AND OPTION AWARDS ($)(1) |

| THRESHOLD ($) | | TARGET ($) | | MAXIMUM ($) | |

Steve Hislop | | 2/23/2017 | | 3/15/2017 | | — |

| | 315,412 |

| | 630,823 |

| | 22,290 |

| | 630,807 |

|

Jon Howie | | 2/23/2017 | | 3/15/2017 | | — |

| | 157,481 |

| | 314,962 |

| | 8,347 |

| | 236,220 |

|

Michael Hatcher | | 2/23/2017 | | 3/15/2017 | | — |

| | 62,400 |

| | 124,800 |

| | 3,674 |

| | 103,974 |

|

Sharon Russell | | 2/23/2017 | | 3/15/2017 | | — |

| | 32,850 |

| | 65,700 |

| | 2,901 |

| | 82,098 |

|

| |

(1) | Represents the aggregate grant date fair value, calculated in accordance with FASB ASC Topic 718, for awards of restricted stock units. See Note 11 to our consolidated financial statements for a discussion of the calculations of grant date fair value. |

2012 Omnibus Equity Incentive Plan

The purposes of the 2012 Plan are to provide additional incentives to our management, employees, directors, independent contractors and consultants, to strengthen their commitment, motivate them to faithfully and diligently perform their responsibilities and to attract and retain competent and dedicated persons whose contributions are essential to the success of our business and whose efforts will impact our long-term growth and profitability. To accomplish such purposes, the 2012 Plan provides for the issuance of stock options, share appreciation rights, restricted shares, restricted stock units, performance shares and other share-based awards, which we refer to as plan awards.

Summary of 2012 Plan Terms

We reserved a total of 1,250,000 shares of common stock that are available for issuance under the 2012 Plan. The maximum aggregate awards that may be granted during any fiscal year to any individual will be 200,000 shares, and in the case of options to acquire shares, with a per share exercise price equal to the grant date fair market value of a share. If the shares underlying any plan award are forfeited, canceled, exchanged or surrendered or if a plan award otherwise terminates or expires without a distribution of shares, the shares will again become available under the 2012 Plan provided that shares surrendered or withheld as payment of either the exercise price of an award (including shares otherwise underlying an award of a share appreciation right that are retained by us to account for the grant price of such share appreciation right) and/or withholding taxes in respect of an award will no longer be available for grant under the 2012 Plan, and notwithstanding that a share appreciation right is settled by the delivery of a net number of shares of the full number of shares underlying such share appreciation right will not be available for subsequent awards under the 2012 Plan. In addition, the number of shares for awards that are paid or settled in cash will again be available for grants of awards under the 2012 Plan. Shares underlying awards that can only be settled in cash will not be counted against the aggregate number of shares available for awards under the 2012 Plan.

The 2012 Plan is administered by our compensation committee (the "Plan Administrator"). The Plan Administrator may construe and interpret the 2012 Plan and may adopt, alter and repeal rules and make all other determinations necessary or desirable to administer the 2012 Plan.

The Plan Administrator may select the employees, directors, independent contractors and consultants who will receive plan awards, determine the terms and conditions of those awards, including but not limited to the exercise price, the number of shares of common stock subject to awards, the term of the awards, and the vesting schedule applicable to awards. Unless otherwise determined by the Plan Administrator, all awards that vest solely on a requirement of continued employment or service may not become fully vested prior to the second anniversary of the date upon which the award is granted.

We may issue stock options under the 2012 Plan. All stock options granted under the 2012 Plan are intended to be non-qualified stock options and are not intended to qualify as incentive stock options within the meaning of Section 422 of the Code. The option exercise price of all stock options granted under the 2012 Plan will be determined by the Plan Administrator, but in no event will the exercise price be less than 100% of the fair market value of the common stock on the date of grant. The term of all stock options granted under the 2012 Plan will be determined by the Plan Administrator, but may not exceed ten years from the date of grant. Each stock option will be exercisable at such time

and subject to such terms and conditions as determined by the Plan Administrator in the applicable stock option agreement. Other than equitable adjustments made in connection to a change in capitalization, under no circumstances will an exercise price be reduced following the date of the grant of an option, nor will an option be cancelled in exchange for a replacement option with a lower exercise price without stockholder approval.

Unless the applicable stock option agreement provides otherwise, in the event of an optionee’s termination of employment or service for any reason other than for cause, disability or death, such optionee’s stock options (to the extent exercisable at the time of such termination) generally will remain exercisable until 30 days after such termination and then expire. Unless the applicable stock option agreement provides otherwise, in the event of an optionee’s termination of employment or service due to, disability or death, such optionee’s stock options (to the extent exercisable at the time of such termination) generally will remain exercisable until one year after such termination and will then expire. For certain employees, a demotion in position will result in a loss of unvested options. If termination was for any other reason other than for cause, stock options that were not exercisable on the date of termination will expire at the close of business on the date of such termination. In the event of an optionee’s termination of employment or service for cause, such optionee’s outstanding stock options will expire at the commencement of business on the date of such termination. The Plan Administrator may waive the vesting requirements based on such factors as the Plan Administrator deems appropriate.

Share appreciation rights (“SARs”) may be granted under the 2012 Plan either alone or in conjunction with all or part of any stock option granted under the 2012 Plan. A free-standing SAR granted under the 2012 Plan entitles its holder to receive, at the time of exercise, the number of shares, or alternate form of payment determined by the Plan Administrator, equal in value to the excess of the fair market value (at the date of exercise) over a specified price fixed by the Plan Administrator (which shall be no less than fair market value at the date of grant). A SAR granted in conjunction with all or part of an option under the 2012 Plan entitles its holder to receive, upon surrendering of the related option, the number of shares, or alternate form of payment determined by the Plan Administrator, equal in value to the excess of the fair market value (at the date of exercise) over the exercise price of the related stock option. The term of all SARs granted under the 2012 Plan will be determined by the Plan Administrator, but may not exceed ten years from the date of grant. In the event of a participant’s termination of employment or service, free-standing SARs will be exercisable at such times and subject to such terms and conditions determined by the Plan Administrator, while SARs granted in conjunction with all or part of an option will be exercisable at such times and subject to terms and conditions applicable to the related option. Other than equitable adjustments made in connection to a change in capitalization, under no circumstances will an exercise price be reduced following the date of the grant of a SAR, nor will a SAR be cancelled in exchange for a replacement SAR with a lower exercise price without stockholder approval.

Restricted shares, restricted stock units and performance shares may be granted under the 2012 Plan. The Plan Administrator will determine the number of shares to be awarded, the purchase price, vesting schedule and performance objectives, if any, applicable to the grant of restricted shares, restricted stock units and performance shares. Participants with restricted shares and performance shares generally have all of the rights of a stockholder and restricted stock units generally do not have the rights of a stockholder. However, during the restricted period, restricted stock units may be paid dividends on the number of shares covered by the restricted stock units if the applicable award agreement so provides. If the performance goals and other restrictions are not satisfied, the restricted shares, restricted stock units and/or performance shares will be forfeited in accordance with the terms of the grant. Subject to the provisions of the 2012 Plan and applicable award agreement, the Plan Administrator has sole discretion to provide for the lapse of restrictions in installments or the acceleration or waiver of restrictions (in whole or part) under certain circumstances, based upon such factors including, but not limited to, the attainment of certain performance goals, a participant’s termination of employment or service or a participant’s death or disability.