0001524931PRE 14Afalse00015249312021-12-272022-12-25iso4217:USD00015249312020-12-282021-12-2600015249312019-12-302020-12-270001524931ecd:PeoMemberchuy:SummaryCompensationTableStockAwardsMember2021-12-272022-12-250001524931chuy:YearEndFairValueOfUnvestedAwardsGrantedInYearMemberecd:PeoMember2021-12-272022-12-250001524931ecd:PeoMemberchuy:ChangeInFairValueOfOutstandingUnvestedAwardsGrantedInPriorYearsMember2021-12-272022-12-250001524931ecd:PeoMemberchuy:ChangeInFairValueOfAwardsGrantedInPriorYearsThatVestedOrExercisedInFiscalYearMember2021-12-272022-12-250001524931ecd:PeoMemberchuy:SummaryCompensationTableStockAwardsMember2020-12-282021-12-260001524931chuy:YearEndFairValueOfUnvestedAwardsGrantedInYearMemberecd:PeoMember2020-12-282021-12-260001524931ecd:PeoMemberchuy:ChangeInFairValueOfOutstandingUnvestedAwardsGrantedInPriorYearsMember2020-12-282021-12-260001524931ecd:PeoMemberchuy:ChangeInFairValueOfAwardsGrantedInPriorYearsThatVestedOrExercisedInFiscalYearMember2020-12-282021-12-260001524931ecd:PeoMemberchuy:SummaryCompensationTableStockAwardsMember2019-12-302020-12-270001524931chuy:YearEndFairValueOfUnvestedAwardsGrantedInYearMemberecd:PeoMember2019-12-302020-12-270001524931ecd:PeoMemberchuy:ChangeInFairValueOfOutstandingUnvestedAwardsGrantedInPriorYearsMember2019-12-302020-12-270001524931ecd:PeoMemberchuy:ChangeInFairValueOfAwardsGrantedInPriorYearsThatVestedOrExercisedInFiscalYearMember2019-12-302020-12-270001524931chuy:SummaryCompensationTableStockAwardsMemberecd:NonPeoNeoMember2021-12-272022-12-250001524931chuy:YearEndFairValueOfUnvestedAwardsGrantedInYearMemberecd:NonPeoNeoMember2021-12-272022-12-250001524931ecd:NonPeoNeoMemberchuy:ChangeInFairValueOfOutstandingUnvestedAwardsGrantedInPriorYearsMember2021-12-272022-12-250001524931ecd:NonPeoNeoMemberchuy:ChangeInFairValueOfAwardsGrantedInPriorYearsThatVestedOrExercisedInFiscalYearMember2021-12-272022-12-250001524931chuy:SummaryCompensationTableStockAwardsMemberecd:NonPeoNeoMember2020-12-282021-12-260001524931chuy:YearEndFairValueOfUnvestedAwardsGrantedInYearMemberecd:NonPeoNeoMember2020-12-282021-12-260001524931ecd:NonPeoNeoMemberchuy:ChangeInFairValueOfOutstandingUnvestedAwardsGrantedInPriorYearsMember2020-12-282021-12-260001524931ecd:NonPeoNeoMemberchuy:ChangeInFairValueOfAwardsGrantedInPriorYearsThatVestedOrExercisedInFiscalYearMember2020-12-282021-12-260001524931chuy:SummaryCompensationTableStockAwardsMemberecd:NonPeoNeoMember2019-12-302020-12-270001524931chuy:YearEndFairValueOfUnvestedAwardsGrantedInYearMemberecd:NonPeoNeoMember2019-12-302020-12-270001524931ecd:NonPeoNeoMemberchuy:ChangeInFairValueOfOutstandingUnvestedAwardsGrantedInPriorYearsMember2019-12-302020-12-270001524931ecd:NonPeoNeoMemberchuy:ChangeInFairValueOfAwardsGrantedInPriorYearsThatVestedOrExercisedInFiscalYearMember2019-12-302020-12-27000152493112021-12-272022-12-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ý

Filed by a Party other than the Registrant ¨

Check the appropriate box:

ý Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to § 240.14a-12

(Name of Registrant as Specified in Its Charter) (Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

ý No fee required

¨ Fee paid previously with preliminary materials

¨ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

June __, 2023

Dear Chuy’s Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Chuy’s Holdings, Inc. The meeting will be held on Thursday, July 27, 2023, beginning at 9:00 a.m., Central time, at the Chuy’s headquarters located at 1623 Toomey Rd., Austin, TX 78704.

Information about the meeting and details concerning the matters to be acted upon at the meeting are described in the following notice of Annual Meeting and proxy statement. We hope that you will plan to attend the Annual Meeting.

It is important that your shares be represented. Whether or not you plan to attend the meeting, please vote using the procedures described on the notice of internet availability of proxy materials or on the proxy card or sign, date and promptly return a proxy card in the provided pre-addressed, postage-paid envelope.

We look forward to seeing you at the meeting on July 27th.

Sincerely,

Steve Hislop

Chairman, President and Chief Executive Officer

CHUY’S HOLDINGS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on July 27, 2023

The 2023 Annual Meeting of Stockholders of Chuy’s Holdings, Inc. (the “Company”) will be held on July 27, 2023, beginning at 9:00 a.m., Central time, at the Chuy’s headquarters located at 1623 Toomey Rd., Austin, TX 78704. The meeting will be held for the following purposes:

1. to elect three directors to serve until the 2026 Annual Meeting of Stockholders, each for a term of three years;

2.to approve, on an advisory basis, the compensation of our named executive officers;

3.to approve the Chuy’s Holdings, Inc. 2023 Employee Stock Purchase Plan;

4.to approve an amendment to the Company’s Certificate of Incorporation to eliminate personal liability of officers for monetary damages for breach of fiduciary duty as an officer;

5. to approve an amendment to the Company’s Bylaws to add an exclusive forum provision;

6. to ratify the appointment of RSM US LLP as the Company’s independent registered public accounting firm for 2023; and

7. to transact such other business as may properly come before the meeting.

Information concerning the matters to be voted upon at the meeting is set forth in the accompanying proxy statement. We have also enclosed or made available to our stockholders the Company’s 2022 Annual Report. Holders of record of the Company’s common stock as of the close of business on May 30, 2023 are entitled to notice of, and to vote at, the meeting.

Your vote is very important. Whether or not you plan to attend the meeting, please vote using the procedures described on the notice of internet availability of proxy materials or on the proxy card or sign, date and promptly return a proxy card in the provided pre-addressed, postage-paid envelope.

By Order of the Board of Directors,

Tim Larson

Vice President, General Counsel and Secretary

Austin, Texas

June __, 2023

| | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JULY 27, 2023.

The Company’s Notice of Annual Meeting, Proxy Statement and 2022 Annual Report to Stockholders are available on the internet at www.proxyvote.com. |

Table of Contents

Chuy’s Holdings, Inc.

1623 Toomey Road

Austin, Texas 78704

PROXY STATEMENT

This proxy statement provides information in connection with the solicitation of proxies by the board of directors of Chuy’s Holdings, Inc. (the “Company”) for use at the Company’s 2023 Annual Meeting of Stockholders or any postponement or adjournment thereof (the “Annual Meeting”) to be held on Thursday, July 27, 2023, beginning at 9:00 a.m., Central time, at the Chuy’s headquarters located at 1623 Toomey Rd., Austin, TX 78704. This proxy statement also provides information you will need in order to consider and act upon the matters specified in the accompanying notice of Annual Meeting. A Notice of Internet Availability of Proxy Materials (the “Notice”) and this proxy statement and proxy card, are being mailed to stockholders beginning on or about June __, 2023.

Record holders of the Company’s common stock as of the close of business on May 30, 2023 are entitled to vote at the Annual Meeting. Each record holder of common stock on that date is entitled to one vote at the Annual Meeting for each share of common stock held. As of May 30, 2023, there were [__] shares of common stock outstanding.

You cannot vote your shares unless you are present at the Annual Meeting or you have previously given your proxy. You can vote by proxy in one of three ways:

•by internet: visit the website shown on your Notice or proxy card and follow the instructions; or

•by telephone: dial the toll-free number shown on your proxy card and follow the instructions; or

•in writing: sign, date, and return a proxy card in the provided pre-addressed, postage-paid envelope.

You may revoke your proxy at any time prior to the vote at the Annual Meeting by:

•delivering a written notice revoking your proxy to the Company’s Secretary at the address above;

•delivering a new proxy bearing a date after the date of the proxy being revoked; or

•voting in person at the Annual Meeting.

Unless revoked as described above, all properly executed proxies, will be voted at the Annual Meeting in accordance with your directions on the proxy. If a properly executed proxy gives no specific instructions, the shares of common stock represented by your proxy will be voted:

•FOR the election of the three nominees to serve as directors until the 2026 Annual Meeting of Stockholders;

•FOR the approval of the compensation of our named executive officers;

•FOR the approval of the Chuy’s Holdings, Inc. 2023 Employee Stock Purchase Plan;

•FOR the approval of an amendment to the Company’s Certificate of Incorporation to eliminate personal liability of officers for monetary damages for breach of fiduciary duty as an officer;

•FOR the approval of an amendment to the Company’s Bylaws to add an exclusive forum provision;

•.FOR the ratification of the appointment of RSM US LLP as the Company’s independent registered public accounting firm for 2023; and

•.at the discretion of the proxy holders with regard to any other matter that is properly presented at the Annual Meeting.

If you own shares of common stock held in “street name” and you do not instruct your broker how to vote your shares using the instructions your broker provides you, your shares will be voted in the ratification of the appointment of RSM US LLP as the Company’s independent registered public accounting firm for 2023, but not for any other proposal. To be sure your shares are voted in the manner you desire, you should instruct your broker how to vote your shares.

Holders of a majority of the outstanding shares of the Company’s common stock must be present, either in person or by proxy, to constitute a quorum necessary to conduct the Annual Meeting. Abstentions and broker non-votes are counted for purposes of determining a quorum and are considered present and entitled to vote.

The following table sets forth the voting requirements, whether broker discretionary voting is allowed and the treatment of abstentions and broker non-votes for each of the matters to be voted on at the Annual Meeting.

| | | | | | | | | | | | | | | | | | | | |

| Proposal | | Vote Necessary to Approve Proposal | | Broker Discretionary Voting Allowed? | | Treatment of Abstentions and Broker Non-Votes |

| No. 1 - Election of directors | | Plurality (that is, the largest number) of the votes cast | | No | | Abstentions and broker non-votes are not considered votes cast and will have no effect on the matter |

| No. 2 - Approval of the compensation of our named executive officers, as disclosed in this proxy statement | | Affirmative vote of the majority of the votes of the shares present in person or by proxy at the Annual Meeting and entitled to vote on the matter | | No | | Abstentions will have the effect of a vote cast against the matter

Broker non-votes are not considered entitled to vote on the matter and will have no effect on the matter |

| No. 3 - Approval of the Chuy’s Holdings, Inc. 2023 Employee Stock Purchase Plan | | Affirmative vote of the majority of the votes of the shares present in person or by proxy at the Annual Meeting and entitled to vote on the matter | | No | | Abstentions will have the effect of a vote cast against the matter

Broker non-votes are not considered entitled to vote on the matter and will have no effect on the matter |

| No. 4 - Approval of an amendment to the Company’s Certificate of Incorporation to eliminate personal liability of officers for monetary damages for breach of fiduciary duty as an officer | | Affirmative vote of a majority of the outstanding shares of our common stock | | No | | Abstentions and broker non-votes will have the effect of a vote cast against the matter

|

| No. 5 - Approval of an amendment to the Company’s Bylaws to add an exclusive forum provision | | Affirmative vote of the majority of the votes of the shares present in person or by proxy at the Annual Meeting and entitled to vote on the matter | | No | | Abstentions will have the effect of a vote cast against the matter

Broker non-votes are not considered entitled to vote on the matter and will have no effect on the matter |

| No. 6 - Ratification of the appointment of RSM US LLP | | Affirmative vote of the majority of the votes of the shares present in person or by proxy at the Annual Meeting and entitled to vote on the matter | | Yes | | Abstentions will have the effect of a vote cast against the matter |

Attendance at the Annual Meeting will be limited to stockholders of record and beneficial owners who provide proof of beneficial ownership as of the record date (such as an account statement, a copy of the voting instruction card provided by a broker, bank, trustee, or nominee, or other similar evidence of ownership).

The Company pays the costs of soliciting proxies. We have engaged Georgeson, Inc. to serve as our proxy solicitor for the Annual Meeting at a base fee of $9,500 plus reimbursement of reasonable expenses. Georgeson will provide advice relating to the content of solicitation materials, solicit banks, brokers, institutional investors, and hedge funds to determine voting instructions, monitor voting, and deliver executed proxies to our voting tabulator. Our employees also may solicit proxies by telephone or in person. However, they will not receive additional compensation for soliciting proxies. The Company may request banks, brokers, and other custodians, nominees, and fiduciaries to forward copies of these proxy materials to the beneficial holders and to request instructions for the execution of proxies. The Company may reimburse these persons for their related expenses. Proxies are solicited to provide all record holders of the Company’s common stock an opportunity to vote on the matters to be presented at the Annual Meeting, even if they cannot attend the meeting in person.

Proposal 1 –

Election of Directors

At the Annual Meeting, three directors will be elected to serve three-year terms expiring at our Annual Meeting of Stockholders in 2026. This section contains information relating to the three director nominees and the directors whose terms of office continue after the Annual Meeting. The director nominees were selected by the Nominating and Corporate Governance Committee and approved by the board of directors for submission to the stockholders. A non-management director initially recommended that the nominating and corporate governance committee consider Ms. Bilney as a potential director candidate. The nominees for election are Mr. Hislop, Mr. Howie and Ms. Bilney. All currently serve as directors.

The board of directors recommends a vote “FOR” the election of each of the nominees.

Nominees to be elected for terms expiring at the Annual Meeting in 2026

Steve Hislop, age 63, has served as President, Chief Executive Officer and a member of our board of directors since July 2007 and chairman of the board since May 2018. Mr. Hislop serves as President and Chief Executive Officer pursuant to the terms of an employment agreement between him and the Company. From July 2006 through June 2007, Steve was President and Chief Executive Officer of Sam Seltzer Steak House. Prior to that, Steve served as the Concept President and a member of the board of directors of O’Charley’s Restaurants, where he helped grow the business from 12 restaurants to a multi-concept company with 347 restaurants. Steve currently serves on the board of directors of Not Your Average Joe's, Inc. and Silver Diner, Inc., which are privately held companies. The board concluded that Steve should serve as a director based upon his operational expertise, knowledge of the restaurant industry and leadership experience.

Jon Howie, age 55, has served as our Chief Financial Officer since August 2011, as our Vice President since April 2013 and as a member of the board since May 2018. Mr. Howie serves as Vice President and Chief Financial Officer pursuant to the terms of an employment agreement between him and the Company. From March 2007 to July 2011, Jon served as the Chief Financial Officer of Del Frisco’s Restaurant Group, LLC. Prior to that, he served for five years as Controller and was then promoted to Chief Accounting Officer and then to Chief Financial Officer of Lone Star Steakhouse & Saloon, Inc. Jon is a certified public accountant and prior to joining Lone Star Steakhouse & Saloon, Inc. was employed as an Audit Senior Manager with Grant Thornton, LLP for one year and served at Ernst & Young LLP for 10 years where he held various audit positions of increasing responsibilities, including Audit Senior Manager. At Grant Thornton and Ernst & Young, he served as an accounting and business advisor to both private and public companies and advised a number of these companies in conjunction with their initial and secondary public offerings. The board concluded that Jon should serve as a director based upon his knowledge of the restaurant industry and our Company and his financial and leadership experience.

Jody Bilney, age 61, has served as a member of our board since April 2021. Jody served as the Chief Consumer Officer of Humana, Inc., a healthcare company, from 2013 until her retirement in 2020, where she led its transformation into a consumer-driven health enterprise across brand development, marketing, the consumer experience, digital, consumer analytics and corporate reputation enhancement. She also was responsible for the company’s Wellness Solutions business. Prior to Humana, Ms. Bilney served as Executive Vice President and Chief Brand Officer for Bloomin’ Brands, Inc., an upscale-casual dining restaurant company with Outback Steakhouse as its flagship chain from 2006 to 2013. There she headed various departments including brand and business strategy, marketing, corporate communications and business development across the enterprise. She was also a key member of the management team that positioned the company for a successful IPO in 2012. Prior to Bloomin’ Brands, she held senior executive positions at Charles Schwab and Verizon, where she led consumer-focused brand-transformation initiatives. Ms. Bilney is a member of the Board of Directors of Masonite, Inc (NYSE: DOOR), Alignment Healthcare (NASDAQ: ALHC) and Cracker Barrel Old Country Store, Inc. (NASDAQ: CBRL). She earned a Bachelor of Science degree in Economics, with a minor in Marketing, from Clemson University. The board

concluded that Jody should serve as a director based on her knowledge of the restaurant industry and her extensive brand development and business strategy experience.

Current directors whose terms expire at the Annual Meeting in 2024

Randall DeWitt, age 64, has served as a member of our board since October 2016. Randall is a well-known restaurant executive with over 29 years of restaurant experience. Randall is the Founder and has been the Chairman of FB Society, formerly known as Front Burner Restaurants since April 1994. FB Society currently has seven different concepts and is known for developing innovative restaurant concepts that span the fast casual, casual and upscale casual dining segments. FB Society operates, among others, Whiskey Cake, Sixty Vines, Mexican Sugar, and Haywire. Prior to founding FB Society, Randall worked for ten years in commercial real estate development and sales. The board concluded that Randall should serve as a director based on his operational and business development experience within the restaurant industry.

Current directors whose terms expire at the Annual Meeting in 2025

Saed Mohseni, age 60, has served as a member of our board since September 2012 and has served as our lead independent director since May 2018. Saed served as the President and Chief Executive Officer and a director of Bob Evans Farms, Inc. from January 2016 until May 2017. In May 2017, he became the Chief Executive Officer of Bob Evans Restaurants, LLC and served in that position through May 2021. Since June 2021, he has served as the Executive Chairman and a member of the board of directors for Bob Evans Restaurants, LLC. Saed has more than 30 years of management experience in the restaurant industry. Prior to joining Bob Evans Farms, Inc., he served as director, President and Chief Executive Officer of Bravo Brio Restaurant Group, Inc., the parent company of BRAVO! Cucina Italiana, and BRIO Tuscan Grille restaurant chains, from 2007 to 2015. He assumed the additional role of President in 2009 and led the company through the IPO process in 2010. Prior to joining Bravo Brio, Saed worked at McCormick & Schmick for 21 years, where he held positions of increasing responsibility, including serving as a director from 2004 to 2007 and as Chief Executive Officer from 2000 to 2007 he led the company through the IPO process in 2004. Saed attended Portland State University and Oregon State University. The board concluded that Saed should serve as a director based upon his experience as an executive and board member and his knowledge of the restaurant industry.

Ira Zecher, age 70, has served as a member of our board since June 2011. Ira has been a Managing Member of ILZ, LLC, an accounting consulting firm since 2010. He previously served as a director, audit committee chairman and nominating and corporate governance committee member of the board of The Habit Restaurants, Inc. from August 2014 to March 2020 and as a director, audit committee chairman and compensation committee member of the board of Norcraft Companies, Inc. from October 2013 to May 2015. Prior to joining the Chuy’s board, Mr. Zecher was with Ernst & Young LLP, a registered public accounting firm, for over 36 years until his retirement as a Partner in 2010. From 1986 to 2010, he served as a Senior Transaction Advisory Services Partner and Far East Private Equity Leader for Ernst & Young, where he advised clients on mergers and acquisitions across a broad range of industries. Prior to joining the transaction advisory services group, Ira provided accounting, audit and business-advisory services to both public and private clients. He received his Bachelor's degree from Queens College of the City of New York. He is also a certified public accountant, a member of the American Institute of Certified Public Accountants and the New York State Society of Certified Public Accountants. He also completed the Executive Program of the Kellogg School of Management at Northwestern University. From 2010 to 2013, he taught in the Graduate Accounting program at Rutgers, the State University of New Jersey. The board concluded that Ira should serve as a director based upon his extensive professional accounting and financial expertise, which allows him to provide key contributions to the board on financial, accounting, corporate governance and strategic matters.

Proposal 2 –

Advisory Vote to Approve the Compensation of

our Named Executive Officers

Pursuant to Section 14A of the Securities Exchange Act of 1934 (the “Exchange Act”), we are submitting the compensation of our named executive officers as disclosed in this proxy statement to our stockholders for an advisory vote.

As described below under the heading “Executive Compensation,” we seek to provide compensation to each named executive officer that is designed to attract, motivate and retain our executive officers. Our compensation program is designed to reward both individual and company performance, while aligning the financial interests of each named executive officer with the interests of our stockholders. The compensation committee sets compensation for each named executive officer at a level it believes is appropriate considering each named executive officer’s annual review, level of responsibility, awards and compensation paid in the past year and progress toward or attainment of previously set personal and corporate goals and objectives.

The vote on this proposal is not intended to address any specific element of compensation. Rather, the vote relates to the overall compensation of our named executive officers, as described under the heading “Executive Compensation” in this proxy statement. We are asking our stockholders to approve the following advisory resolution at our Annual Meeting:

“RESOLVED, that the compensation of the Company’s named executive officers, as disclosed pursuant to the rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, compensation tables and narrative discussion is hereby APPROVED.”

The vote is advisory and is not binding on the Company, our board of directors or the compensation committee. However, the compensation committee expects to consider the outcome of this advisory vote in evaluating whether any actions are appropriate with respect to our compensation program for our executive officers. At our 2018 annual meeting of stockholders, a majority of our stockholders voted in favor of holding advisory votes on the compensation of our named executive officers on an annual basis. In light of this vote, our board of directors determined to hold such advisory votes annually. Unless our board of directors determines otherwise, we will continue to hold advisory votes on the compensation of our named executive officers on an annual basis. The next advisory vote following this year’s vote will be held at the 2024 annual meeting of stockholders.

The board of directors recommends a vote “FOR” the approval of the compensation of our named executive officers.

Proposal 3 –

Approval of the Chuy's Holdings, Inc. 2023 Employee Stock Purchase Plan

Overview

We are asking stockholders to approve the Chuy’s Holdings, Inc. 2023 Employee Stock Purchase Plan (the “ESPP”). Our board of directors approved the ESPP, subject to stockholder approval, at the April 27, 2023 meeting of the board. The purpose of the ESPP is to encourage employee stock ownership, thus aligning employee interests with those of our stockholders, and to enhance the ability of the Company to attract, motivate and retain qualified employees. We believe that the ESPP will offer a convenient means for our employees who might not otherwise own our common stock to purchase and hold shares.

A copy of the ESPP is attached hereto as Appendix A. A more complete understanding of the ESPP’s terms is available by reading the ESPP in its entirety. We are seeking stockholder approval to qualify the ESPP as an “employee stock purchase plan” under Section 423 of the Code and the related regulations.

Shares Subject to the ESPP

The ESPP will cover an aggregate of 500,000 shares of the Company’s common stock. To prevent dilution or enlargement of the rights of participants under the ESPP, appropriate adjustments will be made if any change is made to our outstanding common stock by reason of any merger, reorganization, consolidation, recapitalization, dividend or distribution, stock split, reverse stock split, spin-off or similar transaction or other change in corporate structure affecting our common stock or its value.

ESPP Participants

Generally, all of our employees will be eligible to participate if they are customarily employed by us, or any participating subsidiary, for at least 20 hours per week. However, the plan administrator has certain discretion to vary the eligibility requirements. Specifically, the plan administrator may, prior to an enrollment date for all options granted on such enrollment date in an offering, determine that any of the following is or is not eligible to participate in such offering period: an employee who (i) has not completed at least two years of service (or a lesser period of time determined by the plan administrator) since his or her last hire date, (ii) customarily works not more than 20 hours per week (or a lesser period of time determined by the plan administrator), (iii) customarily works not more than five months per calendar year (or a lesser period of time determined by the plan administrator), (iv) is a highly compensated employee within the meaning of Section 414(q) of the Code or (v) is a highly compensated employee within the meaning of Section 414(q) of the Code with compensation above a certain level or is an officer or subject to disclosure requirements under Section 16(a) of the Exchange Act. It is expected that approximately 2,000 employees will be eligible to participate in the ESPP.

However, an employee may not be granted rights to purchase shares of our common stock under the ESPP if such employee immediately after the grant would own capital stock possessing 5% or more of the total combined voting power or value of all classes of our capital stock; or holds rights to purchase shares of our common stock under all of our employee stock purchase plans that accrue at a rate that exceeds $25,000 worth of shares of our common stock for each calendar year.

Administration

The ESPP will be administered by the board or any committee designated by the board. The plan administrator has broad power to make determinations under the ESPP, to interpret the terms of the ESPP and to establish rules and regulations for its administration. The plan administrator determines whether offers will be made and the beginning and ending dates of the related purchase periods. The plan administrator will have full and exclusive discretionary authority to construe, interpret and apply the terms of the ESPP, delegate ministerial duties to any of our employees, supply omissions or correct defects in the ESPP, designate separate offerings under the ESPP, designate our subsidiaries and affiliates as participating in the ESPP, determine eligibility, adjudicate all disputed claims filed

under the ESPP and establish procedures that it deems necessary for the administration of the ESPP. The plan administrator’s findings, decisions and determinations are final and binding on all participants to the full extent permitted by law.

Purchases Under the ESPP

The plan administrator will determine the length of each offering period. An offering period may be not less than one month nor more than 27 months. We anticipate initiating the ESPP with 12-month offering periods, with each offering period having four three-month purchase periods. The plan administrator determines the purchase price at which shares may be purchased by participants, which will not be less than the lesser of 85% of the fair market value per share of our common stock on the first day of the purchase period or 85% of the fair market value per share on the last day of the purchase period. The plan administrator will determine whether the participants will be subject to any minimum holding period for the shares of common stock purchased under the ESPP.

Prior to the first day of each offering period, each participant will make an election to participate during the offering period. At the end of each purchase period, the participant will receive a number of shares, determined on the last day of the purchase period, equal to the payroll deductions credited during the purchase period divided by the applicable purchase price, except that no fractional shares may be purchased under the ESPP. We intend to initially set the purchase price at a 10% discount from the lesser of the closing price on the first day of the offering period and the closing price on the purchase date. A participant may not purchase shares with a fair market value greater than $25,000 under the ESPP in any calendar year. The plan administrator may, however, modify at its discretion the discount, purchase period, purchase date and other aspects of the ESPP design within the ESPP parameters from time to time.

Participants may purchase shares only by submitting an election form during the election period established by the plan administrator prior to the beginning of each offering period, stating the participant’s election to have after-tax payroll deductions made for the purpose of participating in the ESPP. After initial enrollment in the ESPP, payroll deductions will continue from offering period to offering period unless the participant makes another election to terminate his or her payroll deductions, terminates his or her employment with the Company or becomes ineligible to participate in the ESPP. The amounts deducted will be credited to the participant’s account under the ESPP until the purchase date, but we will not pay any interest on the deducted amounts.

Participants may end their participation at any time during an offering period in accordance with any applicable insider trading policies by submitting to the Company’s stock administration office a written notice of withdrawal in the form determined by the plan administrator or by following an electronic or other withdrawal procedure determined by the plan administrator. In such case, participants will be paid their accrued contributions that have not yet been used to purchase shares of our common stock. Additionally, participation ends automatically upon termination of employment with us. If sufficient shares are not available in any purchase period under the ESPP, the available shares will be allocated pro rata among the participants in that purchase period in the same proportion that their base compensation bears to the total of the base compensations of all participants for that purchase period. Any amounts not applied to the purchase of common stock will be refunded to the participants after the end of the purchase period without interest.

Restriction on Transfer

The right to acquire shares under the ESPP is not transferable.

Change in Control

If there is a change in control of the Company, each right to purchase shares under the ESPP will be assumed or an equivalent right to purchase shares will be substituted by the successor corporation or a parent or subsidiary of such corporation. If the successor corporation fails to assume or substitute for the ESPP purchase rights, the plan administrator will shorten the offering period covered by such ESPP purchase right by setting a new exercise date on which such offering period will end. The new exercise date will occur before the change in control. The plan

administrator will notify each participant in writing or electronically prior to the new exercise date, that the exercise date for the participant’s purchase rights has been changed to the new exercise date and the participant’s purchase rights will be exercised automatically on the new exercise date, unless prior to such date the participant has withdrawn from the offering period.

Amendment and Termination of the ESPP

The plan administrator has the authority to amend, suspend or terminate the ESPP unless the amendment requires stockholder approval pursuant to Section 423 of the Code, other applicable laws or stock exchange rules. The ESPP shall continue in effect for 10 years after the date of stockholder approval.

Application of Funds

We may use the proceeds from the sale of our common stock pursuant to the ESPP for any corporate purpose.

Material U.S. Federal Income Tax Consequences

The following discussion of certain relevant United States federal income tax consequences applicable to the purchase of shares under the ESPP is only a summary of certain of the United States federal income tax consequences applicable to United States residents under the ESPP, and reference is made to the Code for a complete statement of all relevant federal tax provisions. No consideration has been given to the effects of foreign, state, local and other laws (tax or other) on the ESPP or on a participant, which laws will vary depending upon the particular jurisdiction or jurisdictions involved. In particular, participants who are stationed outside the United States may be subject to foreign taxes as a result of the ESPP.

No taxable income will be recognized by a participant, and no deductions will be allowable to the Company upon either the grant or the exercise of rights to purchase shares. A participant only will recognize income when the shares acquired under the ESPP are sold or otherwise disposed of.

The tax due upon sale or other disposition of the acquired shares depends on the length of time that the participant holds the shares.

If the participant sells or otherwise disposes of the purchased shares within two years after the start date of the offering period pursuant to which the shares were acquired or within one year after the actual purchase date of those shares, the participant generally will recognize ordinary income in the year of sale or disposition equal to the amount by which the fair market value of the shares on the purchase date exceeded the purchase price paid for those shares. The Company will be entitled to a corresponding income tax deduction for the amount of income recognized for the taxable year in which such disposition occurs. The amount of this ordinary income will be added to the participant’s basis in the shares, and any additional gain or loss recognized upon the sale or disposition will be a capital gain or loss.

If the participant sells or disposes of the purchased shares more than two years after the start date of the offering period pursuant to which the shares were acquired and more than one year after the actual purchase date of those shares, then the participant generally will recognize ordinary income in the year of sale or disposition equal to the lesser of (i) the amount by which the fair market value of the shares on the sale or disposition date exceeded the purchase price paid for those shares, or (ii) 15% (or such lesser discount in price) of the fair market value of the shares on the start date of that offering period. Any additional gain upon the disposition will be taxed as a long-term capital gain. Alternatively, if the fair market value of the shares on the date of the sale or disposition is less than the purchase price, there will be no ordinary income and any loss recognized will be a long-term capital loss. The Company will not be entitled to an income tax deduction with respect to such disposition.

The tax consequences to a participant may vary depending upon the participant’s individual situation. In addition, various state laws may provide for tax consequences that vary significantly from those described above.

New Plan Benefits

Participation in the ESPP is entirely within the discretion of the eligible employees. Because we cannot presently determine the participation levels by employee, the rate of contributions by employees and the eventual purchase price under the ESPP, it is not possible to determine the value of benefits which may be obtained by executive officers and other employees under the ESPP. Non-employee directors are not eligible to participate in the ESPP.

The board of directors recommends a vote “FOR” the approval of the Chuy’s Holdings, Inc. 2023 Employee Stock Purchase Plan.

Proposal 4 –

Approval of an Amendment to the Company's Certificate of Incorporation to Eliminate Personal Liability of Officers for Monetary Damages for Breach of Fiduciary Duty as an Officer

We are asking stockholders to approve an amendment to our Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”), which currently limits the monetary liability of directors in certain circumstances pursuant to and consistent with Section 102(b)(7) of the General Corporation Law of the State of Delaware (“DGCL”). Effective August 1, 2022, Section 102(b)(7) of the DGCL was amended to authorize exculpation of specified officers of Delaware corporations. Specifically, the amendments permit Delaware corporations to include a provision in their certificates of incorporation to exculpate certain officers, in addition to their directors, for personal liability for breach of the duty of care in certain actions. The board is proposing to amend the Company’s Certificate of Incorporation to include a provision that extends exculpation to certain officers of the Company in specific circumstances, to the extent permitted by Delaware law (the “Exculpation Amendment”).

As amended, Section 102(b)(7) of the DGCL only permits exculpation for direct claims brought by stockholders for breach of an officer’s fiduciary duty of care, including class actions, and accordingly would not eliminate officers’ monetary liability for breach of fiduciary duty claims brought by the Company itself or for derivative claims brought by stockholders in the name of the Company. Furthermore, consistent with the protections currently afforded to our directors under Article VIII of our Certificate of Incorporation, the Exculpation Amendment would not limit the liability of officers for any breach of the duty of loyalty to the Company or our stockholders, any acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of the law, and any transaction from which the officer derived an improper personal benefit.

The Exculpation Amendment will not be retroactive to any act or omission occurring prior to its effective date. Further, the exculpation would only apply to certain officers, namely a person who (during the course of conduct alleged to be wrongful) (i) is or was president, chief executive officer, chief operating officer, chief financial officer, chief legal officer, controller, treasurer or chief accounting officer; (ii) is or was identified in the Company’s public filings with the SEC as one of the most highly compensated executive officers of the Company; or (iii) has, by written agreement with the Company, consented to be identified as an officer for purposes of accepting service of process.

As part of the board’s ongoing evaluation of the Company’s corporate governance practices, the board considered the benefits and detriments of eliminating the personal liability of its officers under certain circumstances.

We believe adopting the Exculpation Amendment would enable the Company’s officers to exercise their business judgment in furtherance of our stockholders’ interests without the potential distraction of risking personal liability. Further, enhancing the Company’s ability to retain and attract experienced officers is in the Company’s best interests and the Company should seek to assure such persons that exculpation under certain circumstances is available. We believe that failing to adopt the Exculpation Amendment could impact the Company’s recruitment and retention of exceptional officer candidates who conclude that the potential exposure to liabilities, costs of defense, and other risks of proceedings exceeds the benefits of serving as an officer of the Company.

Prior to the amendment of Section 102(b)(7) of the DGCL, Delaware law permitted Delaware corporations to exculpate directors from personal liability for monetary damages associated with breaches of the duty of care, but that protection did not extend to a Delaware corporation’s officers. Consequently, stockholder plaintiffs have employed the tactic of bringing certain claims that would otherwise be exculpated if brought against directors against officers to avoid dismissal of such claims. The amendment to Section 102(b)(7) of the DGCL addressed this inconsistent treatment between officers and directors and the rising litigation and insurance costs for stockholders. Accordingly, the Exculpation Amendment will generally align the protections available to directors with those available to officers. Further, the Exculpation Amendment will not negatively impact stockholder rights, considering the narrow class and type of claims for which officers’ liability would be exculpated. In addition, the

Company is not proposing the Exculpation Amendment in anticipation of any specific litigation confronting the Company; the Exculpation Amendment is being proposed on a prospective basis to help mitigate potential future harm to the Company and its stockholders.

Based on the benefits the board believes would accrue to the Company and its stockholders in the form of an enhanced ability to attract and retain talented officers and addressing rising litigation and insurance costs for stockholders, the board recommends that our stockholders approve the Exculpation Amendment as described herein.

The discussion above is qualified in its entirety by reference to the full text of the proposed Exculpation Amendment, which is attached hereto as Appendix B. If the stockholders approve the Exculpation Amendment at the Annual Meeting, the Company will file a Certificate of Amendment to the Certificate of Incorporation with the Secretary of State of the State of Delaware that includes the Exculpation Amendment.

The board of directors recommends a vote “FOR” the approval of an amendment to the Company’s Certificate of Incorporation to eliminate personal liability of officers for monetary damages for breach of fiduciary duty as an officer.

Proposal 5 –

Approval of an Amendment to the Company's Bylaws to Add an Exclusive Forum Provision

Our board has approved and recommends that our stockholders approve an amendment to our Bylaws (the “Exclusive Forum Amendment”) to add an exclusive forum provision which would specify that the federal district courts of the United States of America will be the exclusive forum for the resolution of any complaint asserting a cause of action arising under the Securities Act of 1933 (the “Federal Forum Provision”) and a state court located within the State of Delaware will be the exclusive forum for Delaware Law Claims, as defined below (the “Delaware Forum Provision” collectively, the “Exclusive Forum Provision”).

Assuming that stockholders approve this proposal, the principal effects will be that unless the Company consents in writing to the selection of an alternative forum:

•the federal district courts of the United States of America will be the exclusive forum for the resolution of any complaint asserting a cause of action arising under the Securities Act of 1933, subject to and contingent upon a final adjudication in the State of Delaware of the enforceability of such exclusive forum provision; and

•the Court of Chancery of the State of Delaware (or, if and only if the Court of Chancery of the State of Delaware lacks subject matter jurisdiction, any state court located within the State of Delaware or, if and only if all such state courts lack subject matter jurisdiction, the federal district court for the District of Delaware) shall be the sole and exclusive forum for the following types of actions or proceedings under Delaware statutory or common law: (i) any derivative action or proceeding brought on behalf of the Company; (ii) any action asserting a breach of a fiduciary duty owed by any director, officer or other employee of the Company to the Company or the Company’s stockholders; (iii) any action asserting a claim against the Company or any director or officer or other employee of the Company arising pursuant to any provision of the DGCL, the Company’s Amended and Restated Certificate of Incorporation or the Company’s Bylaws; (iv) any action or proceeding to interpret, apply, enforce or determine the validity of the Company’s Amended and Restated Certificate of Incorporation or the Company’s Bylaws (including any right, obligation, or remedy thereunder); (v) any action or proceeding as to which the DGCL confers jurisdiction to the Court of Chancery of the State of Delaware; or (vi) any action asserting a claim against the Company or any director or officer or other employee of the Company that is governed by the internal affairs doctrine, in all cases to the fullest extent permitted by law and subject to the court’s having personal jurisdiction over the indispensable parties named as defendants (clauses (i) – (vi), the “Delaware Law Claims”).

The Exclusive Forum Provision will not apply to suits brought to enforce a duty or liability created by the Exchange Act or any other claim for which the federal courts have exclusive jurisdiction.

We believe that the Federal Forum Provision is in the best interests of the Company. Our board considered a number of factors prior to recommending the Federal Forum Provision as a prudent and proactive means for managing this type of potential litigation and to promote efficient and consistent resolutions in the event this type of litigation arises, including:

(i) the potential for costly, duplicative litigation involving multiple lawsuits in multiple jurisdictions regarding essentially the same claims under the Securities Act of 1933, which could result in increased litigation expenses and greater uncertainty regarding outcomes that may be inconsistent when two or more similar cases proceed in different courts;

(ii) the experience and expertise of the U.S. federal district courts in addressing issues and claims under the Securities Act of 1933 and federal case law regarding the same;

(iii) the risk that a state court may not interpret or apply federal law, specifically the Securities Act of 1933, in the same manner as the U.S. federal district courts would be expected to do, or may handle procedural aspects differently than the U.S. federal district courts would be expected to do;

(iv) the benefits of adopting the Federal Forum Provision when the Company is not facing any actual or threatened shareholder lawsuits under the Securities Act of 1933; and

(v) the views of proxy advisors and certain institutional investors with respect to federal forum provisions.

Moreover, the Federal Forum Provision would not specify any particular U.S. federal district court as the exclusive forum for claims under the Securities Act of 1933, so a plaintiff could select, on the basis of convenience or for other reasons, the U.S. federal district courts in any state as the forum for any such claim. The Federal Forum Provision gives us the flexibility to consent to an alternative forum when we deem appropriate. In addition, we are not proposing the Exclusive Forum Provision in anticipation of any specific litigation confronting the Company; the Exclusive Forum Provision is being proposed on a prospective basis to help mitigate potential future harm to the Company and its shareholders.

We also believe that the Delaware Forum Provision is in the best interests of the Company and will help maximize stockholder value by allowing us to be able to draw upon Delaware’s well-established principles of corporate governance in making business and legal decisions. The Delaware legislature is sensitive to issues of corporate law and responsive to developments in modern corporate law. Delaware’s specialized Chancery Court deals almost exclusively with corporate law and has streamlined procedures and processes to provide relatively quick decisions. In addition, the Delaware Supreme Court, the only Delaware appeals court, is highly regarded. These courts have considerable expertise in dealing with corporate issues and have developed a substantial and influential body of corporate case law. Further, we believe that stockholders and the Company will benefit from the responsiveness of the Delaware courts. Therefore, the prominence, predictability and proactivity of the Delaware courts provides a reliable forum where our governance decisions can be based and litigated.

Although we could adopt the Exclusive Forum Provision without obtaining stockholder approval, we determined that it would be in the best interests of the Company and our stockholders, and consistent with our commitment to strong corporate governance practices, for our stockholders to have the opportunity to consider and act upon the Exclusive Forum Provision.

The discussion above is qualified in its entirety by reference to the full text of the Exclusive Forum Amendment to the Bylaws, which is attached hereto as Appendix C. If the stockholders approve the Exclusive Forum Amendment at the Annual Meeting, the Bylaws will be amended to add the Exclusive Forum Provision.

The board of directors recommends a vote “FOR” the approval of an amendment to the Company’s Bylaws to add an exclusive forum provision.

Proposal 6 -

Ratification of the Appointment of

RSM US LLP as the Company’s Independent

Registered Public Accounting Firm for 2023

The audit committee has appointed RSM US LLP as the Company’s independent registered public accounting firm for 2023. The board of directors is asking stockholders to ratify this appointment. Securities and Exchange Commission (“SEC”) regulations and the Nasdaq listing requirements require the Company’s independent registered public accounting firm to be engaged, retained and supervised by the audit committee. However, the board of directors considers the selection of an independent registered public accounting firm to be an important matter to stockholders. Accordingly, the board of directors considers a proposal for stockholders to ratify this appointment to be an opportunity for stockholders to provide input to the audit committee and the board of directors on a key corporate governance issue.

Representatives of RSM US LLP are expected to be present at the Annual Meeting and will have the opportunity to make a statement. They will also be available to respond to appropriate questions. For additional information regarding our independent registered public accounting firm, see “Independent Public Accountants.”

The board of directors recommends a vote “FOR” the ratification of RSM US LLP as the Company’s independent registered public accounting firm for 2023.

The Board, Its Committees and Its Compensation

Board of Directors

Effective February 9, 2023, Starlette Johnson resigned from the Board of Directors. As a result, our board of directors reduced the size of the board of directors to six members, four of whom are non-employee directors. The board of directors is divided into three classes, with each class serving three-year terms. The term of one class expires at each Annual Meeting of Stockholders.

Director Compensation

The elements of compensation payable to our non-employee directors in 2022 are briefly described in the following table:

| | | | | | | | |

| Board Service: | | |

Annual cash retainer | | $ | 45,000 | |

Annual equity award grant | | $ | 45,000 | |

| Lead Independent Director annual cash retainer | | $ | 5,000 | |

| Board Committee Service: | | |

Audit Committee Chair annual cash retainer | | $ | 10,000 | |

Compensation Committee Chair annual cash retainer | | $ | 5,000 | |

Nominating & Corporate Governance Committee Chair annual cash retainer | | $ | 2,500 | |

Our non-employee directors receive compensation for their services as directors. Our Lead Independent Director and our Committee Chairs receive additional compensation for their service. We reimburse directors for all expenses incurred in attending board meetings.

Grants of equity awards to members of our board of directors are made under the 2020 Omnibus Incentive Plan (the “2020 Plan”). These equity awards vest 25% on each of the first four anniversaries of the grant date.

Director Compensation Table

The following table provides information regarding the compensation of our non-employee directors for the year ended December 25, 2022:

| | | | | | | | | | | | | | | | | | | | |

| NAME | | FEES EARNED OR

PAID IN CASH ($) | | STOCK

AWARDS ($)(1) | | TOTAL ($) |

Starlette Johnson (2) | | 48,750 | | | 44,992 | | | 93,742 | |

| Saed Mohseni | | 52,500 | | | 44,992 | | | 97,492 | |

| Ira Zecher | | 55,000 | | | 44,992 | | | 99,992 | |

| Randall DeWitt | | 45,000 | | | 44,992 | | | 89,992 | |

| Jody Bilney | | 46,250 | | | 44,992 | | | 91,242 | |

(1)These restricted stock units were granted on March 1, 2022 and vest 25% on each of the first four anniversaries of the grant date. The grant date fair value of each award was equal to the closing price of the Company's stock on the date of grant or $31.31, as calculated in accordance with FASB ASC Topic 718. See Note 9 to our consolidated financial statements included in our Annual Report for information regarding the assumptions made in determining these values.

(2)Starlette Johnson resigned effective February 9, 2023.

The following table provides information regarding the aggregate number of restricted stock unit awards held by our non-employee directors as of December 25, 2022:

| | | | | | | | |

| NAME | | AGGREGATE RESTRICTED STOCK UNIT AWARDS |

Starlette Johnson (1) | | 4,007 | |

| Saed Mohseni | | 4,007 | |

| Ira Zecher | | 4,007 | |

| Randall DeWitt | | 4,007 | |

| Jody Bilney | | 2,158 | |

(1)Starlette Johnson resigned effective February 9, 2023.

Director Independence

Our board of directors will review at least annually the independence of each director. During these reviews, the board will consider transactions and relationships between each director (and his or her immediate family and affiliates) and our Company and its management to determine whether any such transactions or relationships are inconsistent with a determination that the director is independent. This review will be based primarily on responses of the directors to questions in a directors’ and officers’ questionnaire regarding employment, business, family, compensation and other relationships with the Company and our management. Our board of directors has determined that each of Jody Bilney, Randall DeWitt, Saed Mohseni and Ira Zecher are independent within the meaning of the Nasdaq Marketplace Rules. As required by the Nasdaq Global Select Market, a majority of our directors are independent and our independent directors meet in regularly scheduled executive sessions at which only independent directors are present.

Corporate Governance

We believe that good corporate governance is important to ensure that, as a public company, we will be managed for the long-term benefit of our stockholders. We and our board of directors have reviewed the corporate governance policies and practices of other public companies, as well as those suggested by various authorities in corporate governance. We have also considered the provisions of the Sarbanes-Oxley Act and the rules of the SEC and the Nasdaq Global Select Market.

Based on this review, we have established and adopted charters for the audit committee, compensation committee and nominating and corporate governance committee, and have adopted corporate governance guidelines, a code of business conduct and ethics applicable to all of our directors, officers and employees and an insider trading policy.

Our committee charters, code of business conduct and ethics and corporate governance guidelines are available on our website at www.chuys.com in the Investors section. Copies of these documents are also available upon written request to our Corporate Secretary. We will post information regarding any amendment to, or waiver from, our code of business conduct and ethics on our website in the Investors section.

Furthermore, our insider trading policy prohibits our directors and certain employees, including all of our executive officers, from engaging in hedging transactions with respect to our securities, including entering into options, warrants, puts, calls or similar instruments or selling our securities short, and pledging shares of our securities in margin accounts.

The board of directors periodically reviews its corporate governance policies and practices. Based on these reviews, the board of directors may adopt changes to policies and practices that are in our best interests and as appropriate to comply with any new SEC or Nasdaq Marketplace Rules.

Board Leadership Structure and Board’s Role in Risk Oversight

Steve Hislop serves as chairman of our board of directors, President and Chief Executive Officer. We believe that the Company and its shareholders are best served by having Mr. Hislop serve in both positions because of his knowledge of the Company’s operations, our unique culture and industry in which we are competing. This leadership structure strengthens the communication link between the operating organization and the board. It also fosters a collaborative environment that supports effective decision-making around key topics such as strategic objectives, long-term planning and enterprise risk management.

Since Mr. Hislop serves as chairman of the board in addition to his roles as President and Chief Executive Officer of the Company, the board determined it was appropriate to appoint a lead independent director, who would be elected annually. Mr. Mohseni was elected to serve as our lead independent director.

The role of our lead independent director is to, among other things, preside at executive sessions of independent directors, serve as a liaison between the independent directors and the chairman, approve board meeting agendas and the information sent to the board, approve meeting schedules to assure that there is sufficient time for discussion of all agenda items, call meetings of independent directors and, if requested by major shareholders, ensure that he or she is available for consultation and direct communication.

Risk is inherent with every business and we face a number of risks as outlined in Item 1A. “Risk Factors” included in our Annual Report. Management is responsible for the day-to-day management of risks we face, while our board of directors, as a whole and through our audit committee, is responsible for overseeing our management and operations, including overseeing its risk assessment and risk management functions. Our board of directors has delegated responsibility for reviewing our policies with respect to risk assessment and risk management to our audit committee through its charter. Our board of directors has determined that this oversight responsibility can be most efficiently performed by our audit committee as part of its overall responsibility for providing independent, objective oversight with respect to our accounting and financial reporting functions, internal and external audit functions and systems of internal controls over financial reporting and legal, ethical and regulatory compliance. Our board of directors has also delegated the oversight of risks related to environmental, social and governance matters to our nominating and corporate governance committee. Our audit and nominating and corporate governance committees will regularly report to our board of directors with respect to their oversight of these areas.

Board Meetings

The board of directors held four meetings during 2022. Each director serving on the board of directors in 2022 attended at least 75% of the total number of meetings of the board of directors and committees on which they served. Under our corporate governance guidelines, each director is expected to devote the time necessary to appropriately discharge his or her responsibilities and to rigorously prepare for, attend and participate in all board of directors meetings and meetings of committees on which he or she serves.

Annual Meetings of Stockholders

The Company’s directors are encouraged to attend our Annual Meeting of stockholders, but we do not currently have a policy relating to directors’ attendance at these meetings. Each director serving on the board of directors in 2022 attended our 2022 Annual Meeting of Stockholders.

Board Committees

Our board of directors has three standing committees: an audit committee, a compensation committee and a nominating and corporate governance committee. The composition and responsibilities of each committee are described below. Members will serve on these committees until their resignation or until otherwise determined by our board of directors.

Audit Committee

Our audit committee is a standing committee of our board of directors. The audit committee met five times in 2022. Our board of directors has adopted a written charter under which the audit committee operates. A copy of the charter, which satisfies the applicable standards of the SEC and the Nasdaq Global Select Market, is available on our website at www.chuys.com. According to our audit committee charter, the functions of our audit committee include, but are not limited to:

•appointing, retaining and determining the compensation for our independent registered public accounting firm;

•reviewing and overseeing our independent registered public accounting firm;

•reviewing and discussing the effectiveness of internal control over financial reporting;

•reviewing and discussing the annual audited and quarterly unaudited financial statements and the selection, application and disclosures of critical accounting policies used in such financial statements; and

•establishing procedures for the receipt, retention and treatment of complaints regarding internal accounting controls.

Our audit committee currently consists of Ira Zecher, Saed Mohseni and Randall DeWitt, with Ira Zecher serving as chair of the committee. All of our audit committee members are independent as defined by Section 10A(m)(3) of the Exchange Act and the Nasdaq Marketplace Rules. Our board of directors has determined that Ira Zecher is an audit committee financial expert.

The audit committee has the authority to engage independent counsel and other advisors as the committee deems necessary to carry out its duties.

Compensation Committee

Our compensation committee is a standing committee of our board of directors. The compensation committee met four times in 2022. Our board of directors has adopted a written charter under which the compensation committee operates. A copy of the charter, which satisfies the applicable standards of the SEC and the Nasdaq Global Select Market, is available on our website at www.chuys.com. The compensation committee’s functions include:

•reviewing and recommending to our board of directors the salaries and benefits for our executive officers;

•recommending overall employee compensation policies; and

•administering our equity compensation plans.

Our compensation committee currently consists of Saed Mohseni, Randall DeWitt and Ira Zecher, with Saed Mohseni serving as chair of the committee. All members of our compensation committee are independent as defined by Section 10(c) of the Exchange Act, Rule 10C of the Exchange Act Rules and the Nasdaq Marketplace Rules.

The compensation committee has the sole authority to retain and terminate compensation consultants to assist in the evaluation of director or executive officer compensation and the sole authority to approve the fees and other retention terms of such compensation consultants. The compensation committee may also retain independent counsel and other independent advisors to assist it in carrying out its responsibilities. The compensation committee may also, in its discretion, delegate specific duties and responsibilities to a subcommittee or an individual committee member, to the extent permitted by applicable law.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee is a standing committee of our board of directors. The nominating and corporate governance committee met four times in 2022. Our board of directors has adopted a written charter under which the nominating and corporate governance committee operates. A copy of the charter,

which satisfies the applicable standards of the SEC and the Nasdaq Global Select Market, is available on our website at www.chuys.com. The functions of our nominating and corporate governance committee include:

•identifying individuals qualified to serve as members of our board of directors;

•recommending to our board nominees for our annual meetings of stockholders;

•evaluating our board’s performance;

•developing and recommending to our board corporate governance guidelines;

•providing oversight with respect to corporate governance;

•overseeing succession planning; and

•overseeing the Company’s strategy, initiatives, risks, opportunities and reporting on material environmental, social and governance matters.

Our nominating and corporate governance committee consists of Jody Bilney, Randall DeWitt and Ira Zecher, with Jody Bilney serving as chair of the committee. All members of our nominating and corporate governance committee are independent as defined by the Nasdaq Marketplace rules.

The nominating and corporate governance committee has the sole authority to retain and terminate any search firm to assist in the identification of director candidates and the sole authority to set the fees and other retention terms of such search firms. The committee may also retain independent counsel and other independent advisors to assist it in carrying out its responsibilities.

Other Committees

Our board of directors may establish other committees as it deems necessary or appropriate from time to time.

Compensation Committee Interlocks and Insider Participation

During fiscal year 2022, Ms. Johnson, Mr. Mohseni and Mr. DeWitt served as members of the compensation committee. No member of the compensation committee (1) was, during fiscal year 2022, or had previously been, an officer or employee of the Company or (2) had any material interest in a transaction with the Company or a business relationship with, or any indebtedness to, the Company. None of our executive officers have served as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our board of directors or compensation committee.

Code of Business Conduct and Ethics

We have adopted a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer, and persons performing similar functions (“covered persons”). A current copy of the code is posted on our website, which is located at www.chuys.com. Any amendments to or waivers from a provision of our code of conduct and ethics that applies to our covered persons and that relates to the elements of Item 406(b) of Regulation S-K will be disclosed on our website promptly following the date of such amendment or waiver.

Qualifications for Director Nominees

The nominating and corporate governance committee is responsible for reviewing with the board of directors, at least annually, the appropriate skills and experience required for members of the board of directors. This assessment includes factors such as judgment, skill, diversity, integrity, experience with businesses and other organizations of comparable size, the interplay of the candidate’s experience with the experience of other board members, and the extent to which the candidate would be a desirable addition to the board of directors and any committees of the board of directors. The nominating and corporate governance committee will identify nominees based upon recommendations by committee members, other board members, members of management, search firms or, as

discussed below, by stockholders. Upon identifying a potential nominee, members of the nominating and corporate governance committee and other members of the board of directors will interview the candidate, and based upon that interview, make a recommendation to our board of directors.

Board Diversity

The nominating and corporate governance committee considers diversity as part of its overall selection strategy. The nominating and corporate governance committee considers diversity in its broadest sense, including diversity in professional and life experiences, education, skills, perspectives and leadership, as well as other individual qualities and attributes that contribute to board heterogeneity, such as race, ethnicity, sexual orientation, gender and national origin. Importantly, the nominating and corporate governance committee focuses on how the experiences and skill sets of each director nominee complements those of fellow directors and director nominees to create a balanced board with diverse viewpoints and deep expertise. The Company believes that the inclusion of diversity as one of many factors considered in selecting director nominees is consistent with the Company's goal of creating a board that best serves our needs and those of our stockholders. Our board is committed to diversity and as such includes directors with gender and ethnic diversity and a diverse set of backgrounds, experience, and skills.

The chart below illustrates the composition of our Board by gender identity and demographic background:

| | | | | | | | | | | |

| Board Diversity Matrix (As of May 8, 2023) |

| Total Number of Directors | 6 |

| FEMALE | | MALE |

| Part I: Gender Identity | |

| Directors | 1 | | 5 |

| Part II: Demographic Background | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| White | 1 | | 5 |

| | | |

| |

| | | |

| Directors who are Military Veterans | 1 |

| |

| Directors who identify as Middle Eastern/North African | 1 |

| | | |

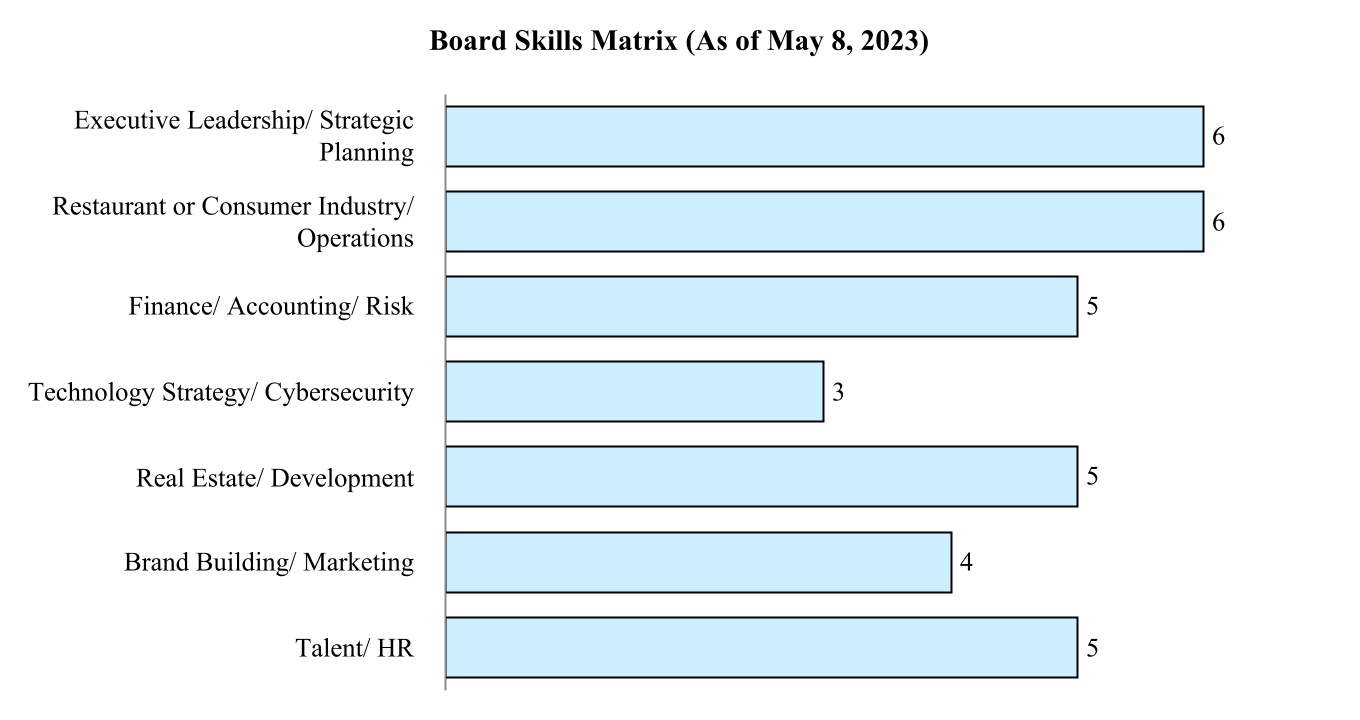

| | | |

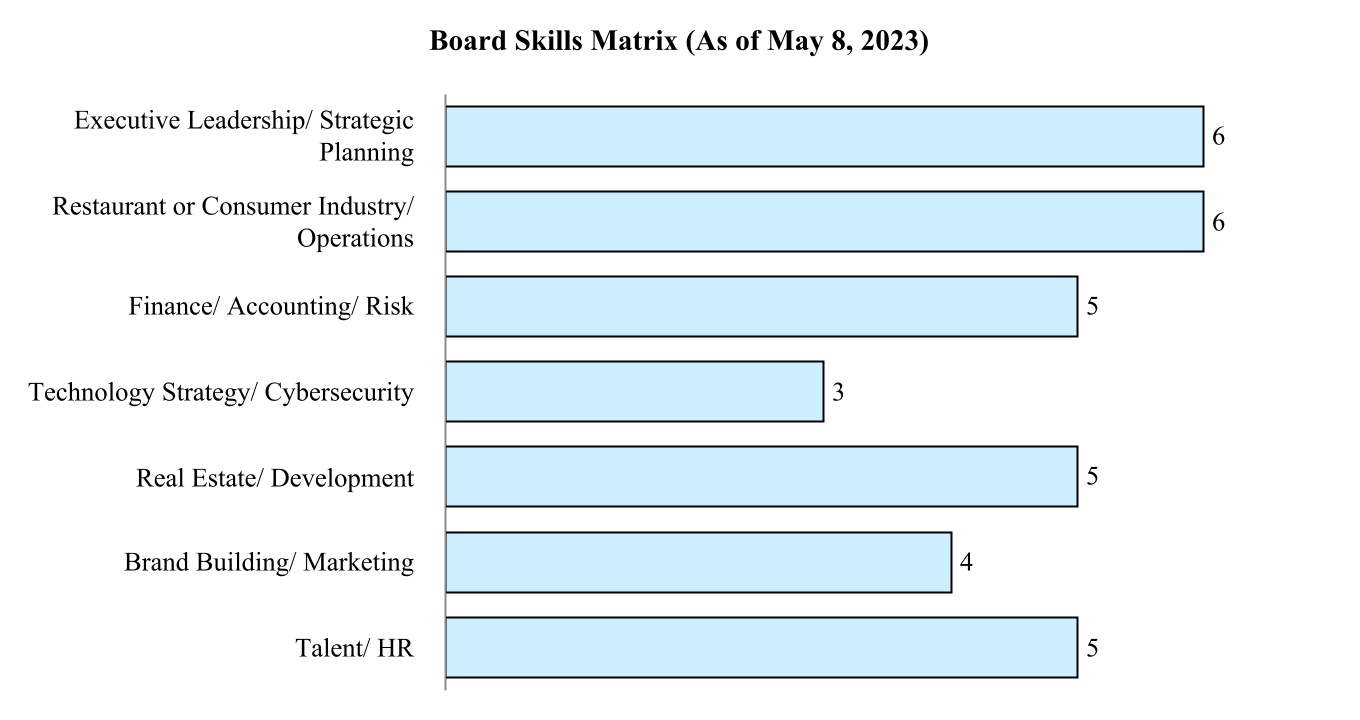

The chart below illustrates the core skills and competency of our board. This highlights the depth and breadth of skills possessed by our directors which provide for the effective oversight of the Company and our overall business strategy:

Director Candidate Recommendations by Stockholders The committee will review and evaluate any director nominations submitted by stockholders, including reviewing the qualifications of, and making recommendations to the board of directors regarding, director nominations submitted by stockholders. See “Communications with the Board of Directors” below for additional information on how to submit a director nomination to the board of directors.

Communications with the Board of Directors

Any stockholder or other interested party who wishes to communicate directly with the board of directors or any of its members may do so by writing to: Corporate Secretary, Chuy’s Holdings, Inc., 1623 Toomey Road, Austin, TX, 78704. The mailing envelope should clearly indicate whether the communication is intended for the board of directors as a group, the non-employee directors or a specific director.

Executive Officers

The following sets forth information regarding the executive officers of the Company as of May 8, 2023:

| | | | | | | | | | | | | | |

| NAME | | AGE | | POSITIONS |

| Steve Hislop | | 63 | | President and Chief Executive Officer |

| Jon Howie | | 55 | | Vice President and Chief Financial Officer |

| John Mountford | | 61 | | Chief Operating Officer |

| Michael Hatcher | | 62 | | Vice President of Real Estate and Development |

| | | | |

| | | | |

Information regarding Messrs. Hislop and Howie is included above under “Election of Directors.”

John Mountford, age 61, has served as our Chief Operating Officer since September 2018. Mr. Mountford serves as Chief Operating Officer pursuant to the terms of an employment agreement between him and the Company. He previously served as our Vice President of Culinary Operations from 2016 to September 2018. He joined the Company in 2010 and served as an Area Supervisor of Operations from 2010 to 2013 and as a Director of Culinary Operations from 2013 to 2016. Prior to joining the Company, John was with Sam Seltzers Steak House from 2006 to 2010. He served as President and Chief Executive Officer from 2007 to 2010 and Vice President of Operations from 2006 to 2007. Prior to Sam Seltzers, John served in various operational leadership positions, including Vice President of Culinary Operations for Cooker Bar and Grill, and Director of Culinary Operations for Houston’s Restaurants where he opened over 30 new restaurants.

Michael Hatcher, age 62, has served as our Vice President of Real Estate and Development since November 2009. Mr. Hatcher serves as Vice President of Real Estate and Development pursuant to the terms of an employment agreement between him and the Company. Michael joined Chuy’s as a restaurant manager in 1987 and served as General Manager from 1989 to 2002. He was Director of Purchasing and Real Estate from 2002 to 2009.

Executive Compensation

Compensation Discussion and Analysis

This compensation discussion and analysis provides an overview of our executive compensation program, together with a description of the material factors underlying the decisions that resulted in the compensation provided to our Chief Executive Officer and Chief Financial Officer and our two other highest paid executive officers during fiscal year 2022 (collectively, the “named executive officers”). During fiscal year 2022, there were only four executive officers of the Company. This compensation discussion and analysis contains statements regarding our performance targets and goals. These targets and goals are disclosed in the limited context of our compensation program and should not be understood to be statements of management’s expectations or estimates of financial results or other guidance. We specifically caution investors not to apply these statements to other contexts.

Objective of Compensation Policy

The objective of our compensation policy is to provide a total compensation package to each named executive officer that will enable us to:

•attract, motivate and retain outstanding individuals;

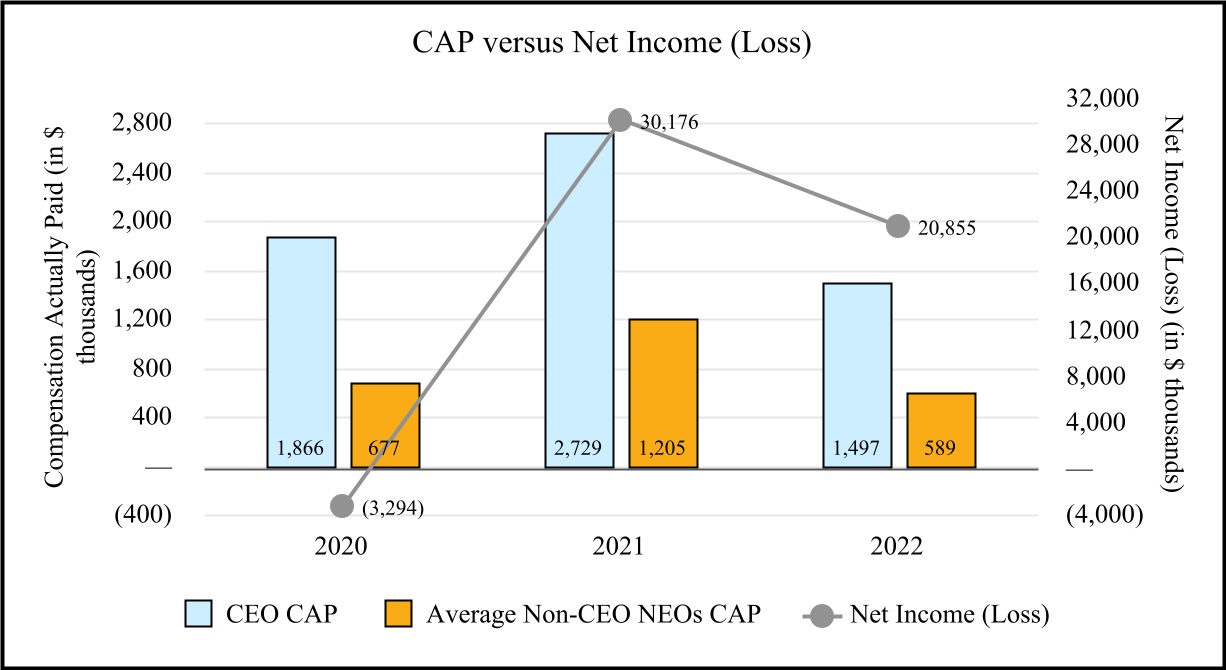

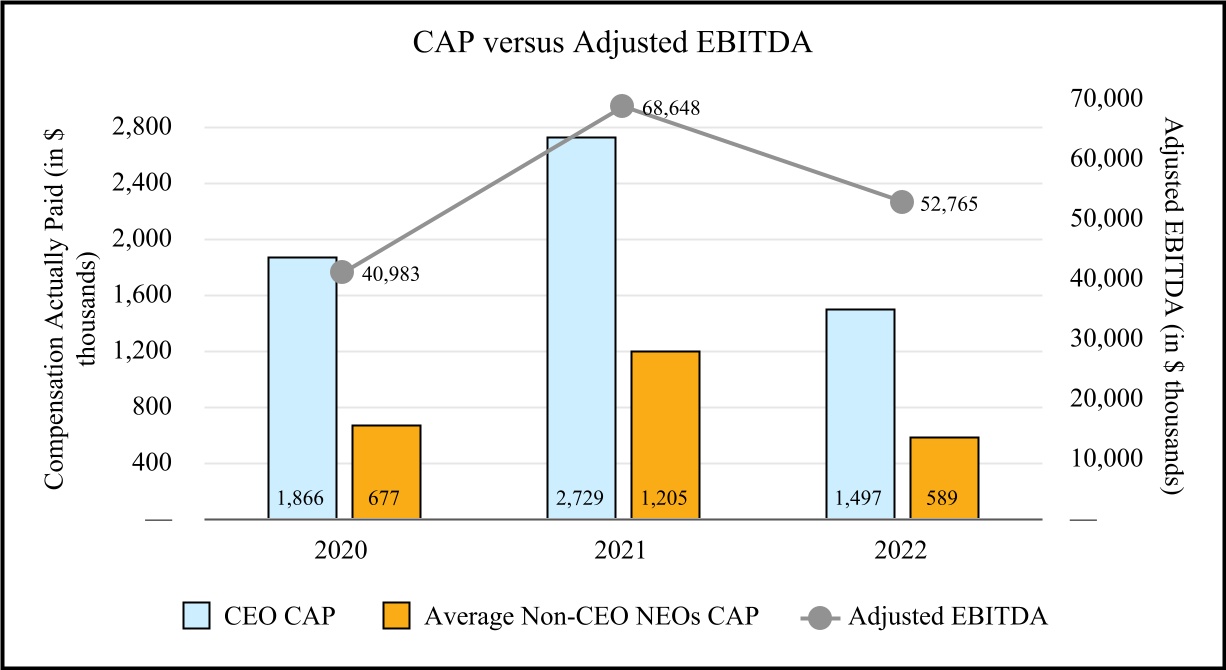

•reward named executive officers for performance; and